The 2025 Q2 @coinbase report, "State of Crypto" is out and a very good read. Here's the TL; DR and key facts/figures on the #RWA front. 🧵

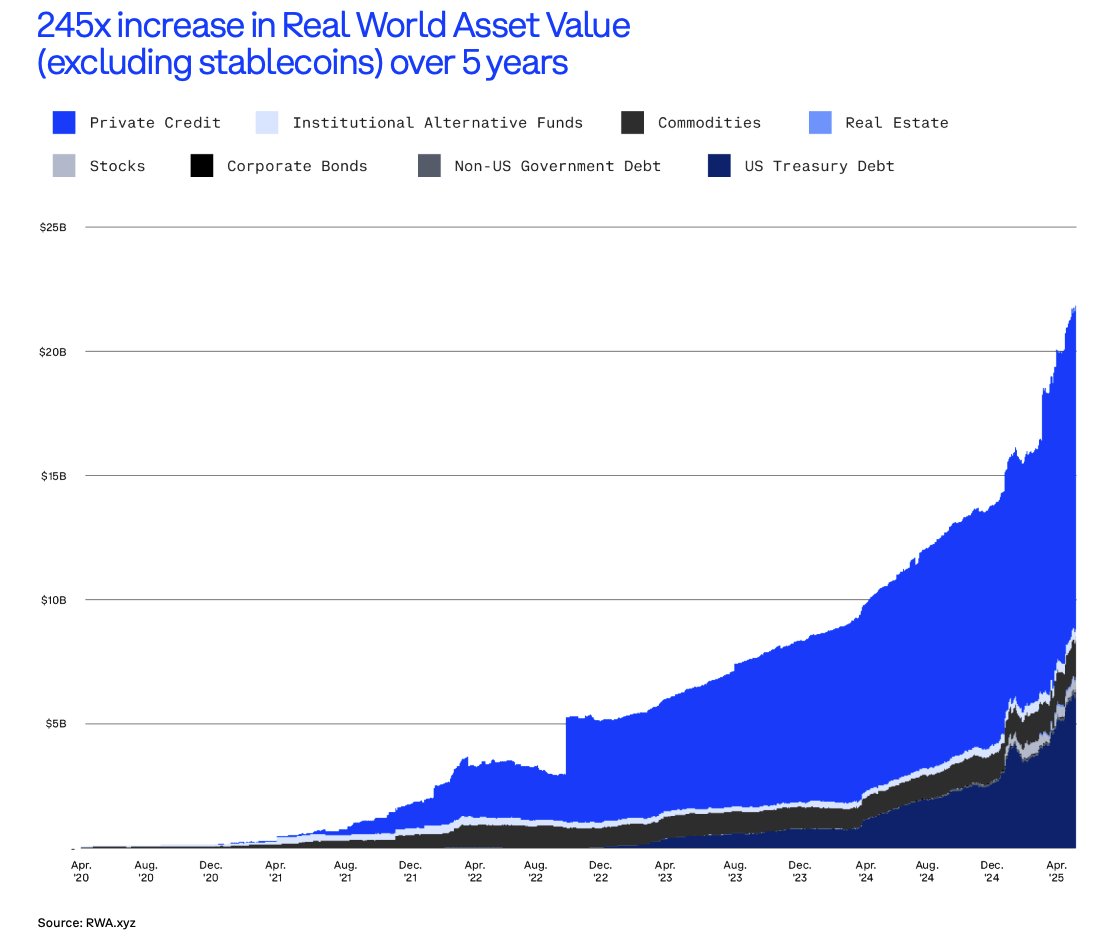

#Tokenization is seeing more than 245 fold growth from $85 million in April 2020 to over $21 billion by April 2025. Private credit dominates at 61% of total tokenized assets, followed by treasuries (30%), commodities (7%), and institutional funds (2%).

Reasons why? 👇

① Tokenized treasuries settle faster, are programmable, and often offer transparent, realtime reporting. For Web3-native companies and DAOs in particular, tokenized treasuries offer a way to earn yield on treasuries without moving funds off chain.

Tokenized U.S. Treasuries have grown from under $500 million in October 2022 to over $6 billion by April 2025.

② Tokenizing invoices and accounts receivable allows businesses to unlock liquidity. Can be fractionalized and offered to global investors in real time, improving access to capital and driving more efficient pricing. Smart contracts can automate payment tracking and enforce terms while likely reducing fraud and admin overhead.

Tokenizing private credit enables broader participation by reducing issuance and investment minimums which makes it easier to tap into retail AUM. This unlocks a deeper and more diverse funding pool for borrowers. Additionally, tokenized debt can be traded on secondary markets, giving investors potential exit liquidity and improving pricing efficiency for issuers.

Private credit tokenization has scaled from near-zero to $12 billion by April 2025.

201

23.43K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.