➤ The large-scale adoption of stablecoins: Does Sui have the opportunity to overtake in the curve on stablecoins?

In the future, with the large-scale adoption of stablecoins, more internet users will enter the Web3 world. Currently, Web3 users make up only about 10% of internet users, indicating significant growth potential.

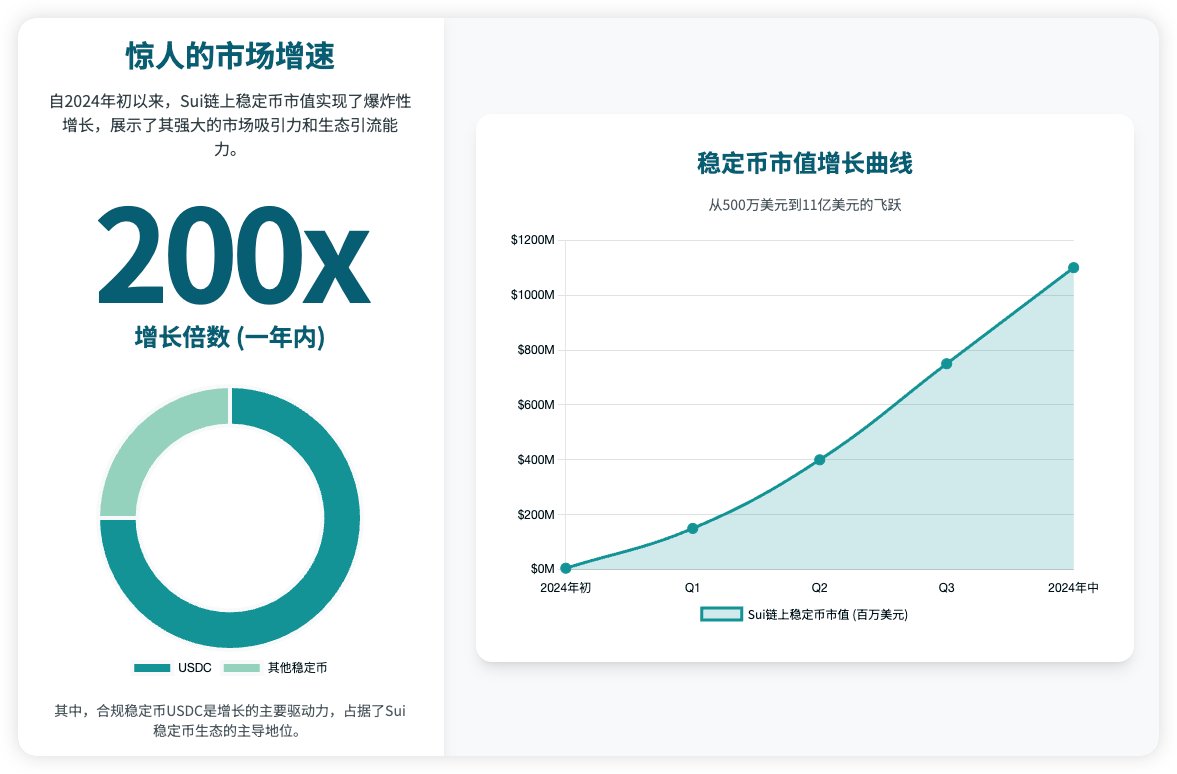

Since 2024, the market value of stablecoins on the Sui chain has experienced explosive growth, increasing nearly 200 times in a year, with the compliant stablecoin USDC being the main driver of this growth, dominating 75% of the Sui stablecoin ecosystem.

Why is there a reason for the potential to overtake?

1. The Sui project originated from the Facebook stablecoin team.

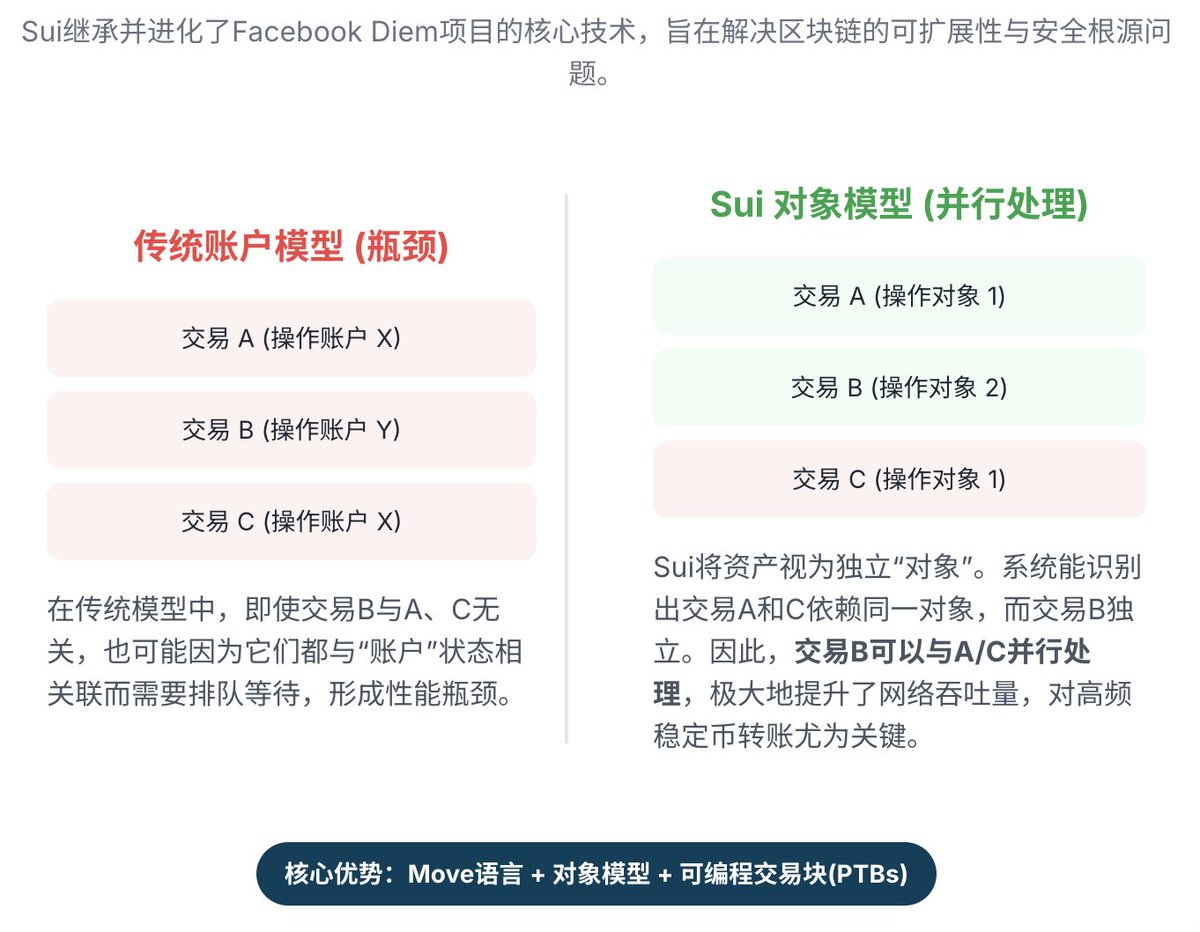

The core members of the Sui team come from Facebook (Meta) Diem/Libra stablecoin project. They are transforming Facebook's technological advantages, such as smart contract language (Move) and high-performance parallel processing, into the underlying architecture of Sui. At that time, the Diem/Libra stablecoin project was already developed, but it was halted due to regulatory issues. Now, with Circle's listing and the relaxation of regulations in the crypto industry, Sui has gained unique advantages in global compliance funding, institutional collaboration, and stablecoin expansion.

3. Advantages of Stablecoin Circulation Technology

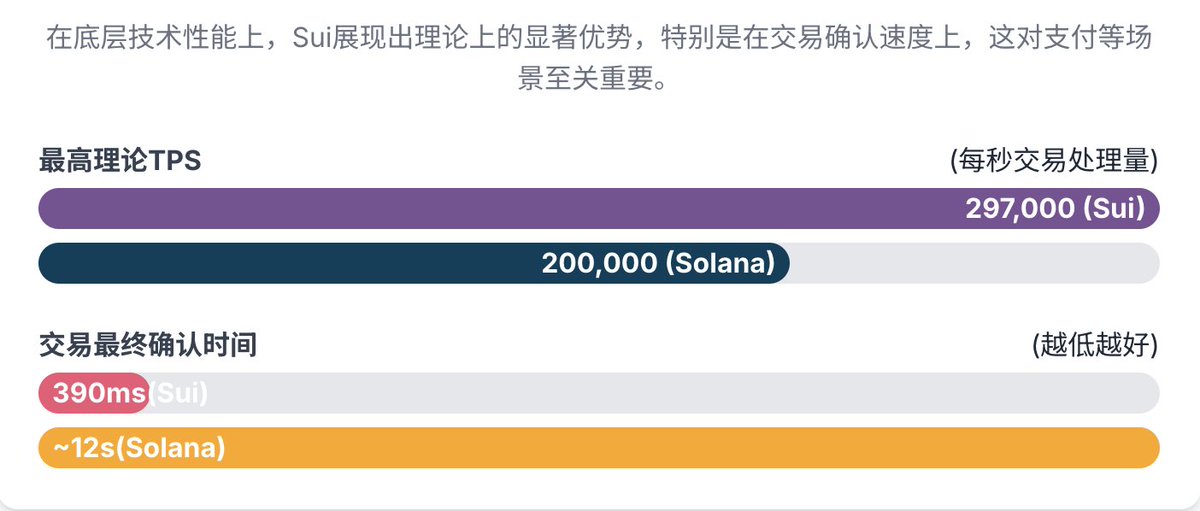

Advantages of MOVE language in security: Designed specifically for digital asset management, it features a resource-oriented programming model. High throughput for parallel transaction processing: VISA and MasterCard handle over 5,000 transactions per second, while Sui can process 100,000 transactions per second.

zklogin connects Web2 users: No need to create a wallet, allowing users to log in through social methods like Google and Facebook.

Extremely low and stable transaction fees: Due to the high throughput architecture, Gas fees remain stable even during peak times.

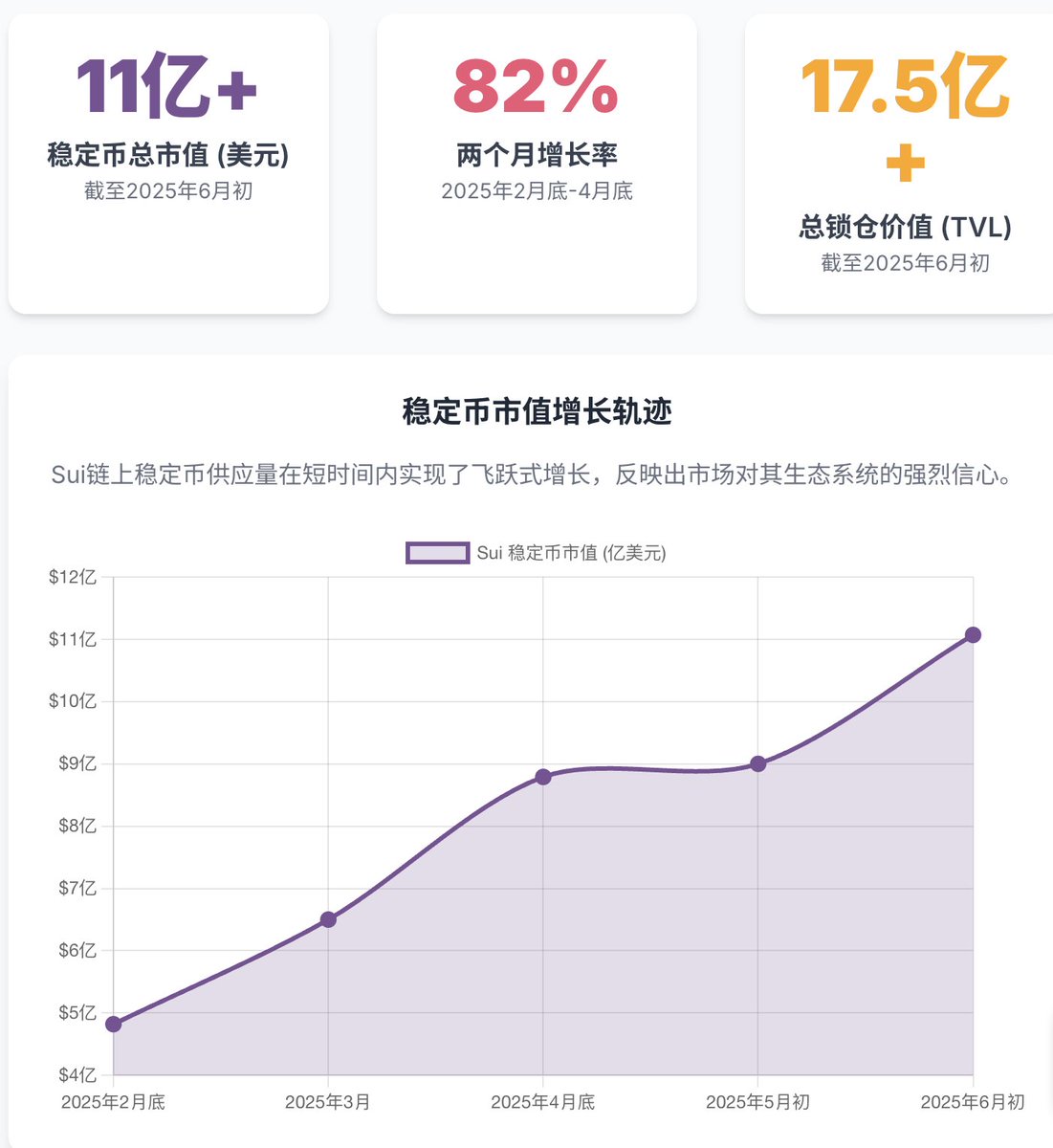

4. Sui's stablecoin market cap is $1.1 billion, the fastest growing

At the beginning of 2024, the stablecoin market cap on Sui was only $5 million, growing more than 200 times in just over a year. Currently, the stablecoin market cap is $1.1 billion, with a growth rate of 82% over the past two months, and a total locked value of $1.75 billion. Since February 2025, it has developed rapidly, mainly driven by USDC, which accounts for as much as 75%. Currently, USDT has not yet been natively issued on the Sui chain. Other native stablecoins include mainstream stablecoins such as AUSD, FDUSD, and USDY.

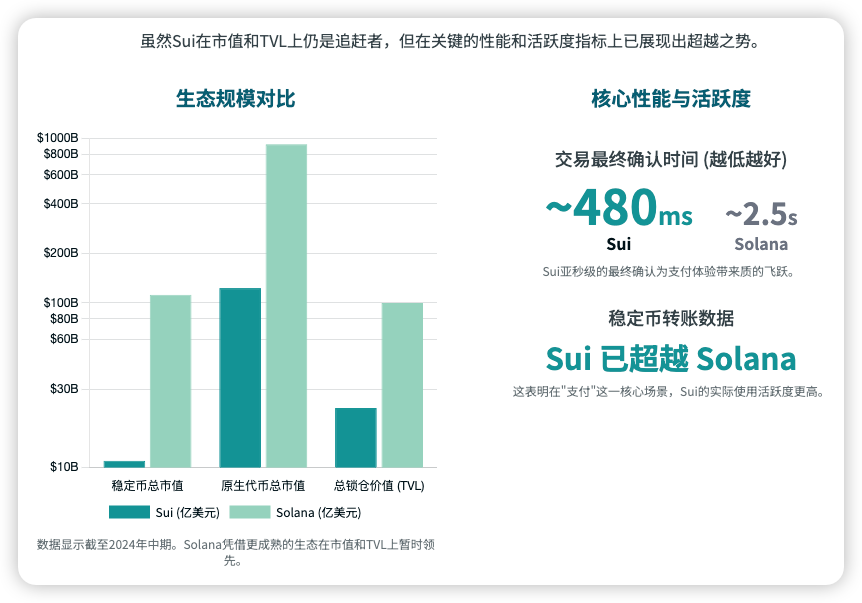

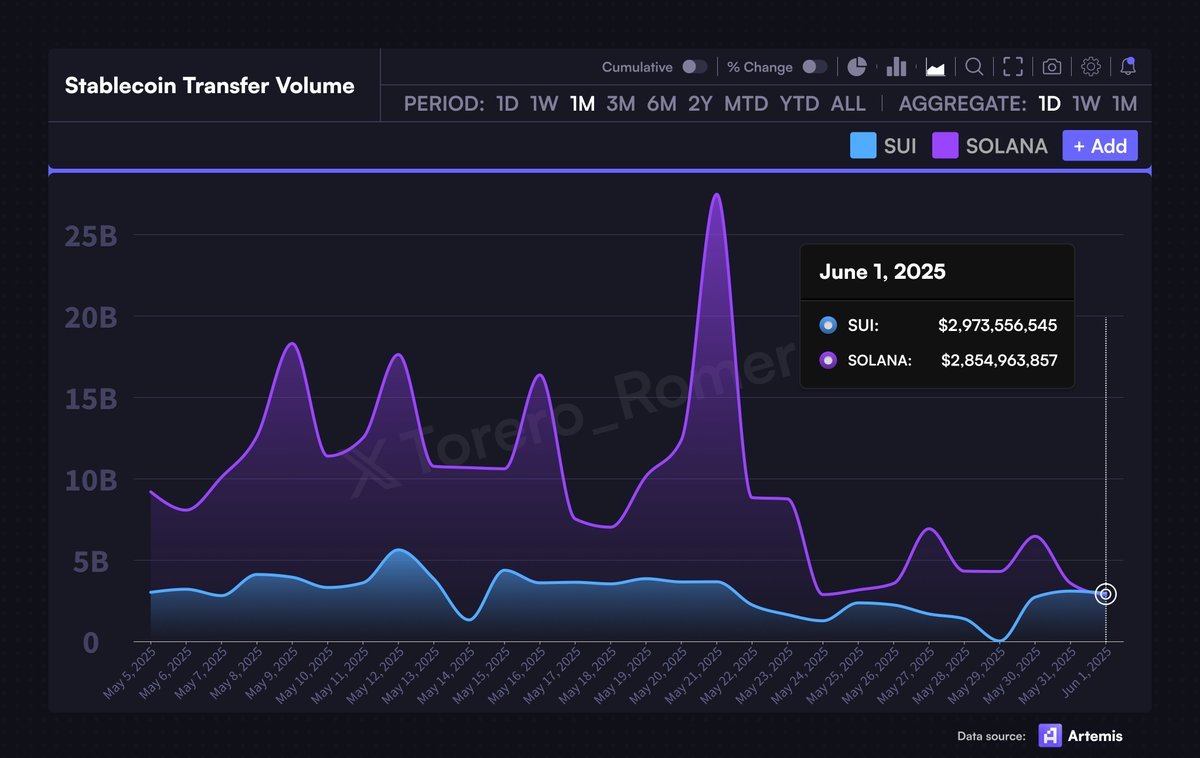

5. Comparison of Sui and SOL Stablecoin Data

Total Market Cap Comparison of Stablecoins: Sui $1.1 billion, SOL $11.2 billion

Native Token Total Market Cap: Sui $12.3 billion, SOL $92 billion

Total Locked Value: Sui $2.3 billion, SOL $10 billion

Sui has just surpassed Solana in stablecoin transfer data, but the issuance of stablecoins between the two differs by nearly 10 times, indicating that stablecoins are more active on Sui. With the growth of issuance scale, there will be larger-scale adoption.

Comparison of Transaction Performance

Sui's opportunity to overtake in payments

Sui's chance lies in leveraging its unique advantages to carve out new battlegrounds, rather than engaging in homogeneous competition in the existing market. Its growth rate is rapid, but there is still a 10-fold gap in scale.

In terms of payment experience, it has a significant advantage with high concurrency, sub-second confirmations, and seamless integration with Web2 social networks, enhancing user experience.

With the relaxation of regulations following Circle's IPO, there is more room for development. The SEC has officially accepted the application for the listing of the SUI ETF by Nasdaq 21Shares. Circle has spent nearly $1 billion on marketing on Coinbase and Binance. In addition to continuing to expand its scale on exchanges, it can also choose to invest in public chains, where $100 million in marketing expenses can lead to tens of billions in scale growth.

More high-frequency application scenarios include Sui's collaboration with xMoney and xPortal to launch a Mastercard, targeting a new type of stablecoin, Game Dollar, for the in-game ecosystem, etc., addressing the financial friction present in traditional payments (such as regional restrictions and high fees) and achieving borderless payments and a better experience through blockchain technology.

122

81.53K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.