The Bitcoin ETF funds experienced a net outflow for the third consecutive trading day, but there was no acceleration in the outflow. On the 3rd, the outflow volume was 267 million, yet the market still managed to achieve a contrarian rise despite the net outflow.

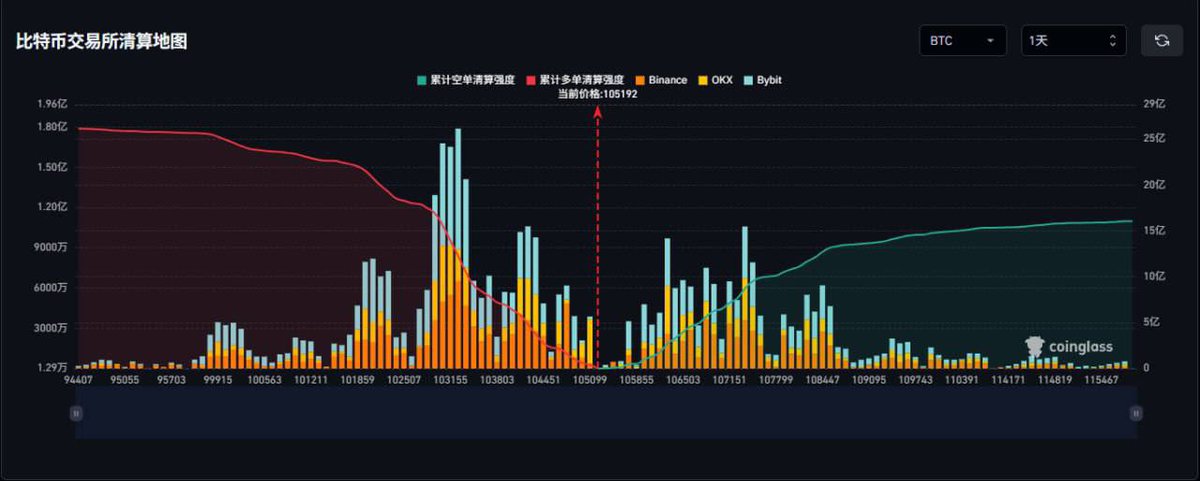

Looking at mainstream CEX liquidation data, the current price is at the 105,000 level. If it drops below 103,000, it will liquidate 1.559 billion long positions; if it breaks above 107,000, it will liquidate 659 million short positions. However, on the weekly level, there is an accumulation of short positions. The long-short ratio shows short-term dominance by shorts, but in the long term, the outlook remains bullish!

Show original

5

130.31K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.