𝙎𝙩𝙖𝙩𝙚 𝙤𝙛 𝙩𝙝𝙚 𝙎𝙤𝙣𝙞𝙘 𝙉𝙚𝙩𝙬𝙤𝙧𝙠

@SonicLabs has been live on mainnet for five months,

superseding Fantom, and is aiming for the DeFi throne.

As Sonic just crossed $1B TVL, the trajectory seems promising.

But is @AndreCronjeTech's new chain living up to the hype?

Time to find out ↓

To set the stage, let's break down Sonic's tech stack on a high level first.

We won't go to deep into the weeds though, for a more detailed breakdown of the network architecture and features, check the quoted post below.

➀ 𝗦𝗼𝗻𝗶𝗰 𝗧𝗲𝗰𝗵 𝗦𝘁𝗮𝗰𝗸:

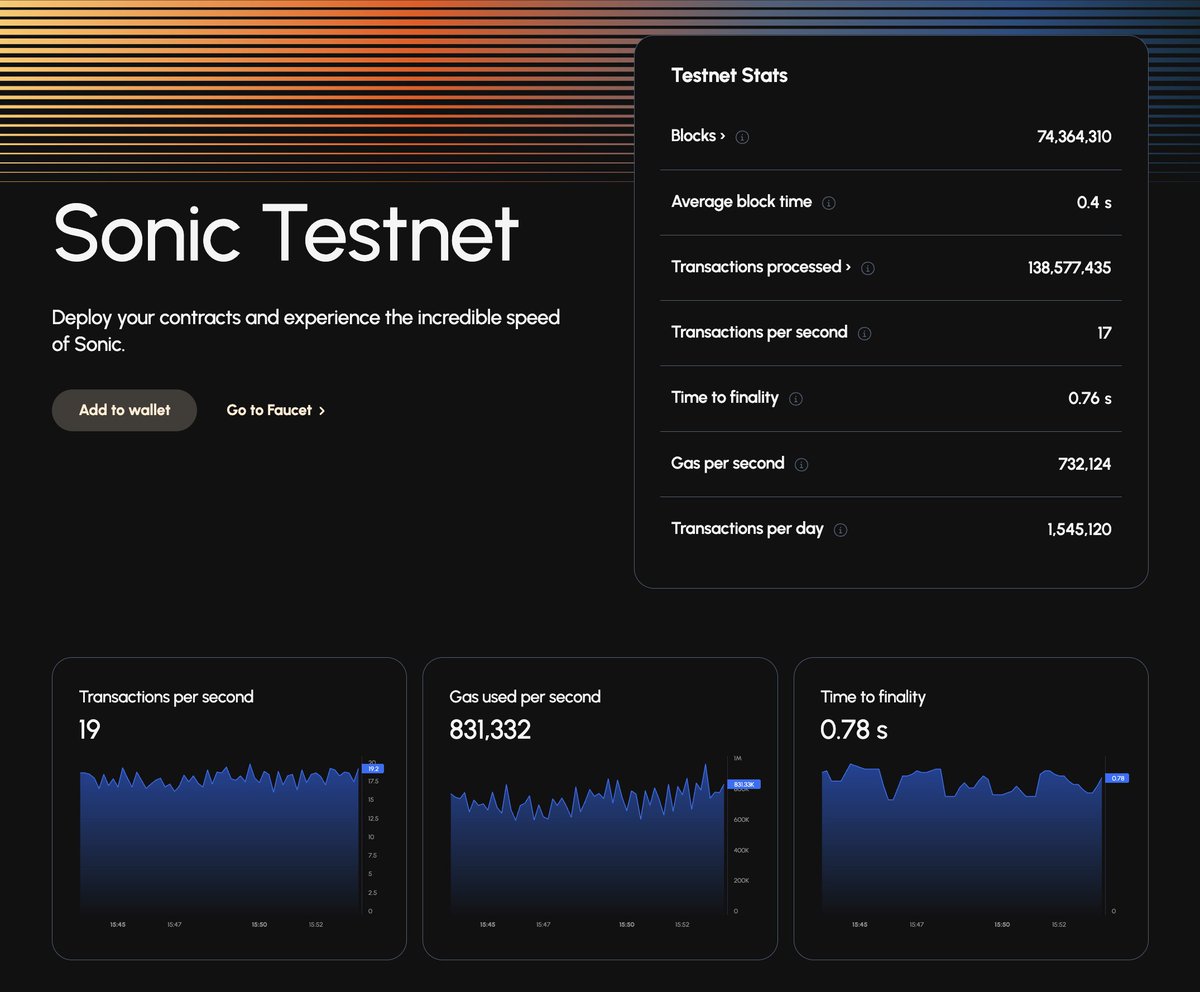

→ Finality of approximately 700ms, outperforming high-performance chains like Aptos (900ms) and significantly ahead of most EVM chains.

→ Achieved throughput of >10,000 TPS, scalable toward 20,000+ with ongoing development to enhance performance through parallel execution.

→ Implements DAG-based asynchronous Byzantine Fault Tolerance (aBFT) consensus (Lachesis) combined with SonicDB, optimizing node storage requirements (~90% reduction compared to Fantom Opera).

→ Uses live pruning to reduce validator storage needs, allowing continuous operation by automatically removing historical data through separate current and archive databases.

→ Minimal transaction fees (typically <1 cent) provide an excellent user experience.

However, while that makes for a strong basis, performance alone is not what drives growth of the onchain economy that Sonic aims to scale.

What really differentiates Sonic from other (EVM) chains, is a bunch of truly unique features, aiming to attract both builders and users effectively.

➁ 𝗖𝗼𝗿𝗲 𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁𝗶𝗮𝘁𝗼𝗿𝘀:

→ Gas Fee Monetization: Developers earn up to 90% of the gas fees generated by their dApps, directly incentivizing high-quality development.

→ Native On-Chain Credit Scoring: Privacy-preserving, on-chain credit scoring without KYC unlocks under-collateralized lending markets estimated at $11.3 trillion.

→ Native Account Abstraction: Seamless onboarding and user interactions via social logins and third-party gas sponsorship.

→ Robust Bridge Security: Sonic Gateway employs decentralized validation and includes built-in emergency withdrawal mechanisms, significantly mitigating traditional bridging risks.

Okay cool, but what about the data?

Are people even using Sonic?

Let's have a closer look at the key ecosystem metrics.

➂ 𝗗𝗮𝘁𝗮-𝗱𝗿𝗶𝘃𝗲𝗻 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀

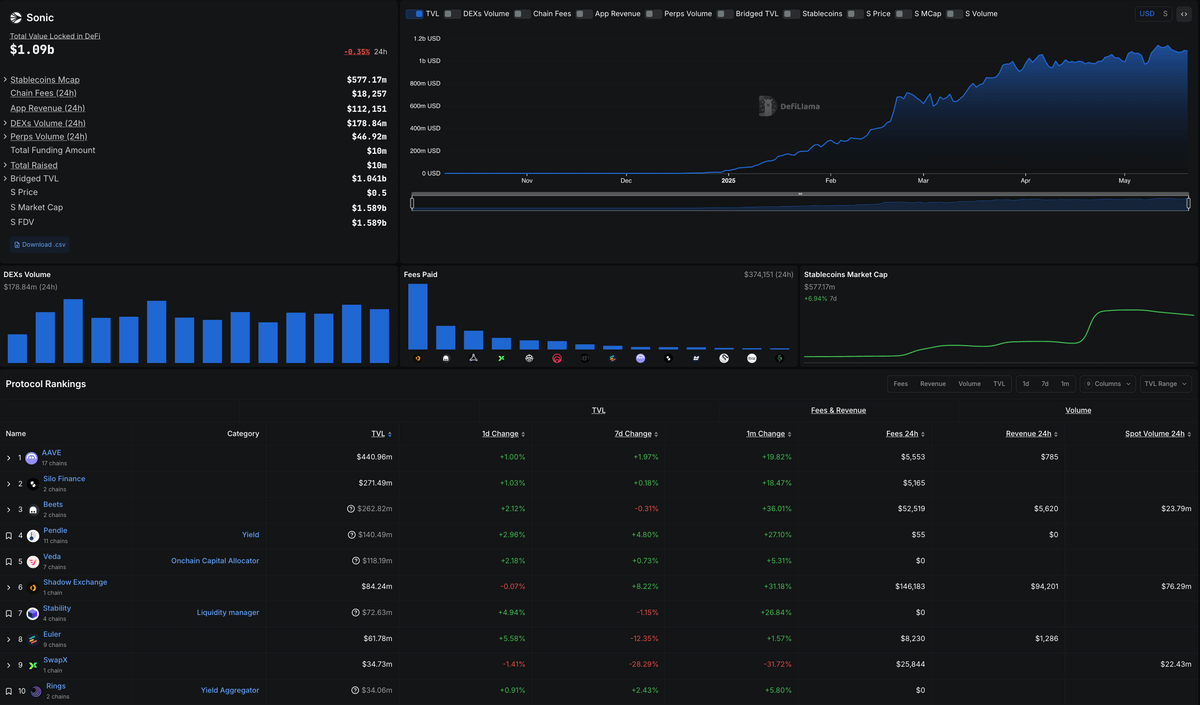

→ Sonic’s TVL rapidly expanded from ~$27M at launch to around $1.09B within five months, demonstrating sustained capital inflow.

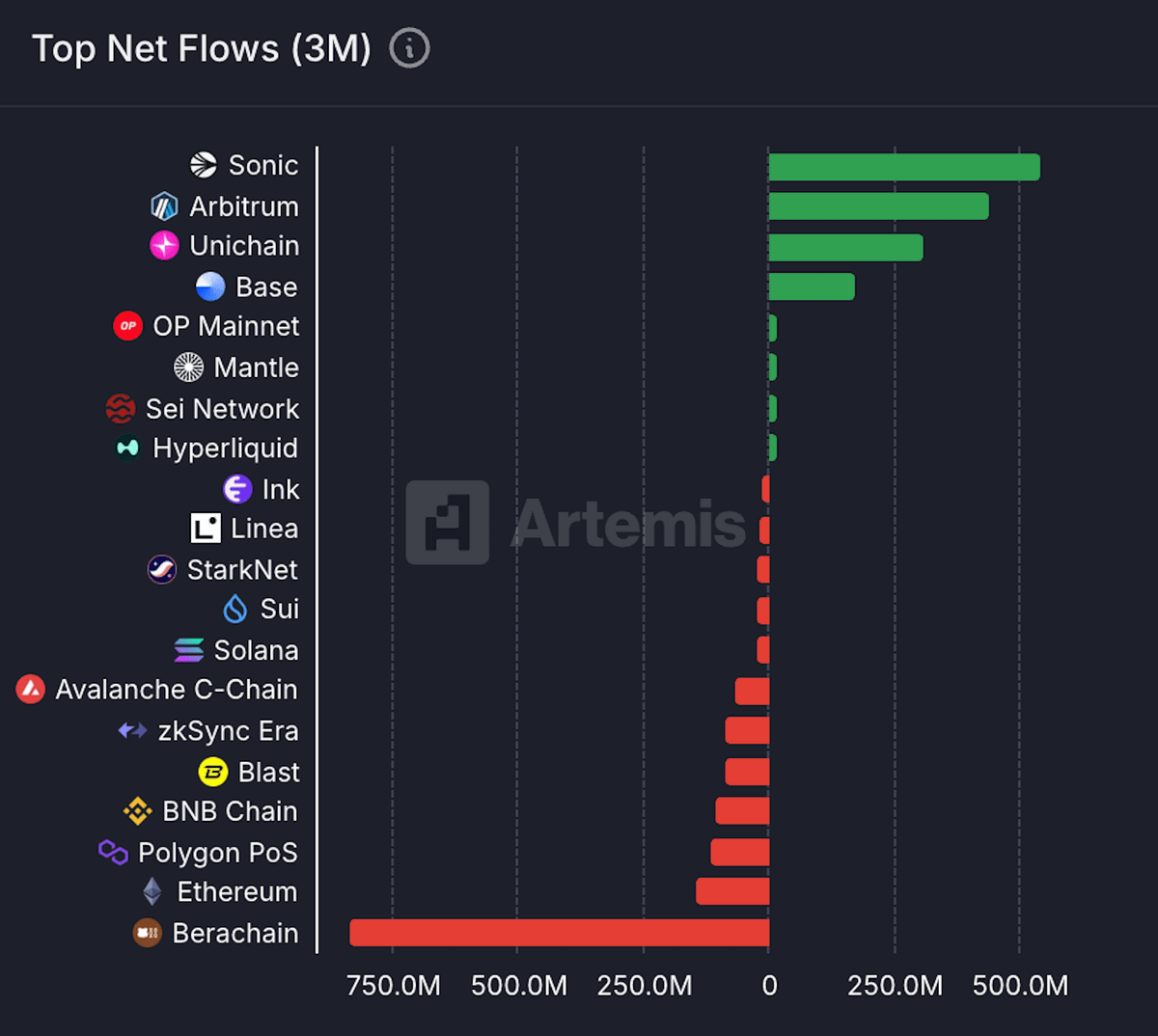

→ Sonic Network secured the highest net inflows (~$505M in the last 3 months, mainly from Ethereum) of all chains, surpassing major competitors such as @arbitrum, @base or @unichain.

→ Dominant DeFi protocols by TVL include @aave V3 ($440.96M), @SiloFinance ($271.49M), and @beets_fi (~$262.82M). This spread of TVL across diverse applications reduces systemic risk and indicates healthy protocol diversification.

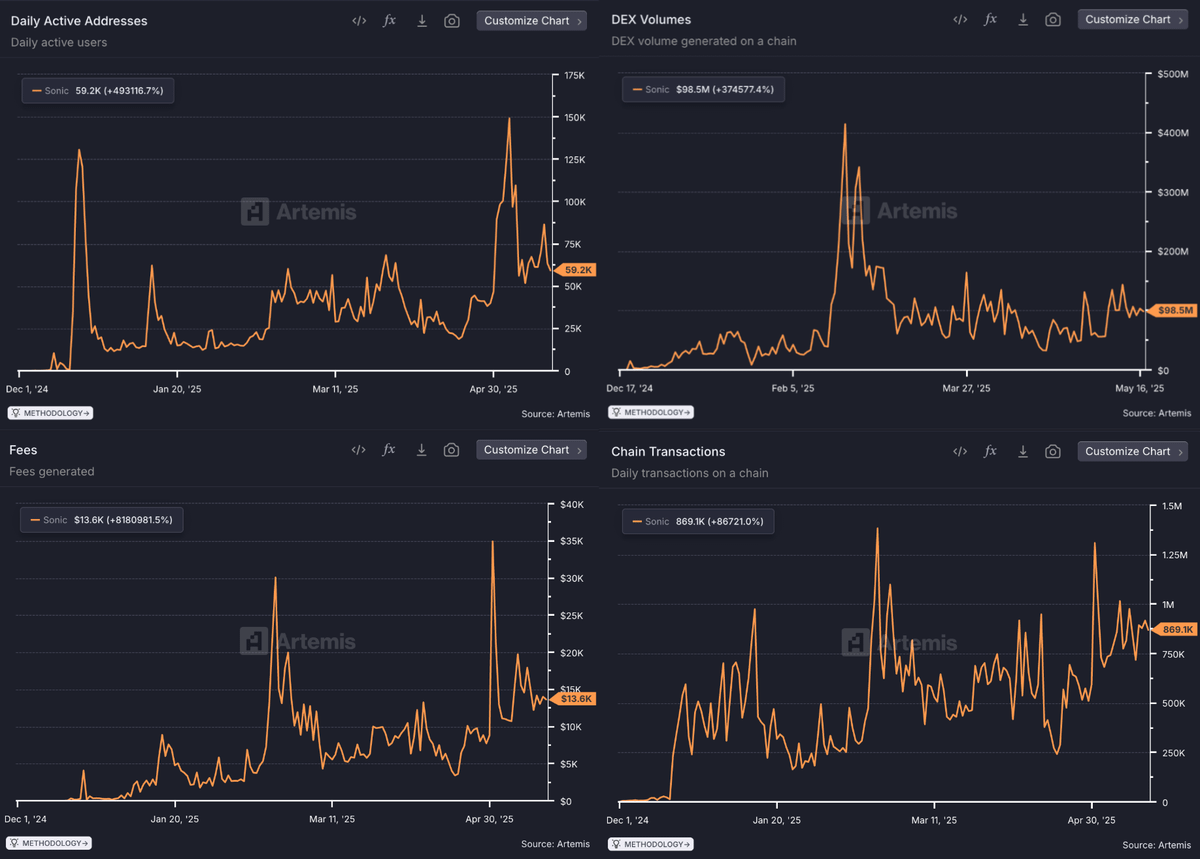

→ Daily Active Addresses have surged to a peak of ~170,000, stabilizing around ~60,000 users, indicating robust user retention for now (even tho this metric can easily be manipulated).

→ Daily transaction volumes consistently exceed 800,000, peaking above 1.3 million, indicative of substantial ongoing engagement beyond initial launch hype. We have to once again keep in mind though that these kinds of metrics are rather easy to manipulate.

→ DEX volumes spiked initially to ~$450M daily, with sustained volumes around ~$100M, evidencing strong and stable trading activity + liquidity. However, the organic volume is likely lower.

→ Generated fees have seen peaks around $35,000 daily, stabilizing around $13,600, highlighting significant economic activity and developer revenue potential.

→ Stablecoin market cap ($577.17M) is growing rapidly and bolsters the network's substantial liquidity depth, supporting trading & lending activities.

Overall, the data clearly shows strong fundamentals, indicating that Sonic's strategy to return to Fantom's old DeFi glory is working well.

However, this begs the question: What exactly are all these users doing with their money on @SonicLabs?

➃ 𝗬𝗶𝗲𝗹𝗱 + 𝗣𝗼𝗶𝗻𝘁 𝗙𝗮𝗿𝗺𝗶𝗻𝗴 𝗼𝗻 𝗦𝗼𝗻𝗶𝗰

Undoubtedly, a strong pull factor that attracts liquidity and users from other chains and ecosystems, is the yields to be farmed across liquidity and lending pools in the Sonic ecosystem.

Various venues offer stablecoin markets that yield attractive APYs of 5-12%, while liquidity pools across the ecosystem provide consistent APRs between 15-30%, with some bearing even higher yields, ensuring sustainable incentives for liquidity providers.

Advanced financial products like @pendle_fi (yield tokenization), @eggsonsonic (leveraged yield farming), and @Rings_Protocol (yield-bearing stablecoins) further provide more sophisticated farming strategy options, and broaden the overall scope of opportunities for users.

Last but not least, staking yields remain comparably attractive at 5-8%, augmented by liquid staking derivatives like $stS, that facilitate further DeFi integration, a major improvement compared to Fantom Opera's staking infra that largely lacked any liquid staking options.

However, it's likely not the APYs alone attracting users and fueling a daily transaction count that consistently exceeds 1 million, and a total of unique addresses that is approaching 2.5 million.

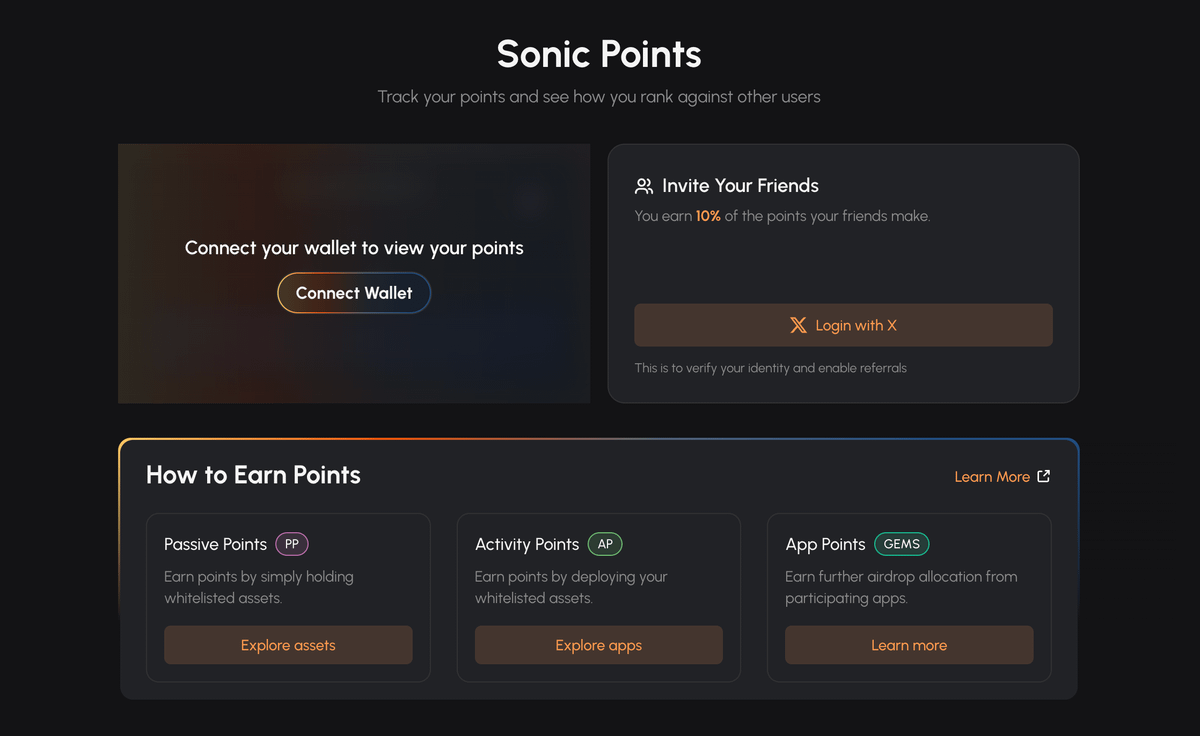

While developer activity is significantly boosted by the Sonic Innovator Fund (200M $S tokens allocated) and Sonic Boom developer incentives, Sonic also employs a strategic points-based incentive system designed to drive user adoption and engagement across the ecosystem.

The Sonic Points system operates by rewarding users for performing various on-chain actions such as trading, lending, providing liquidity, staking, and bridging assets onto the network. Each action grants a user a certain number of points, which accumulate to determine eligibility for targeted airdrops of $S tokens.

To further incentivize specific behaviours aligned with ecosystem growth, Sonic introduced multipliers for certain activities, such as depositing stablecoins into key lending markets or providing liquidity to core trading pairs, granting up to 12-15x point multipliers. This substantially amplifies the perceived value of participating in these critical actions, creating a strong incentive for users to actively and consistently engage with DeFi apps on Sonic.

Consequently, users are motivated not only by immediate yields but also by the substantial potential upside associated with future airdrops. This gamified reward structure has notably contributed to sustained user retention post-launch (at least so far), which is reflected in the ecosystem’s high daily active addresses and stable transaction volumes as well.

Sonic’s points-based airdrop system seems to have effectively catalyzed organic adoption and community growth, ensuring users remain active beyond short-term farming incentives by app layer protocols.

➄ 𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻

Sonic's initial metrics demonstrate decent traction, supported by strong technical capabilities and strategically designed incentives. However, a significant part of its rapid growth appears closely tied to the aggressive reward structures currently in place.

Moving forward, the primary challenge lies in transitioning this incentivized adoption into sustainable organic activity and innovative dApps. While Sonic’s innovations are commendable, the network's true long-term viability and resilience will depend heavily on user retention and ecosystem activity after incentive programs diminish.

It will be particularly interesting to observe whether Sonic can maintain its early momentum and convert transient interest into lasting, fundamental engagement. Sonic's unique DeFi primitives and integrated features such as onchain credit scoring, gas fee monetization and native account abstraction could be crucial here.

⚠️ This is not financial advice and the report is NOT sponsored by any third-party.

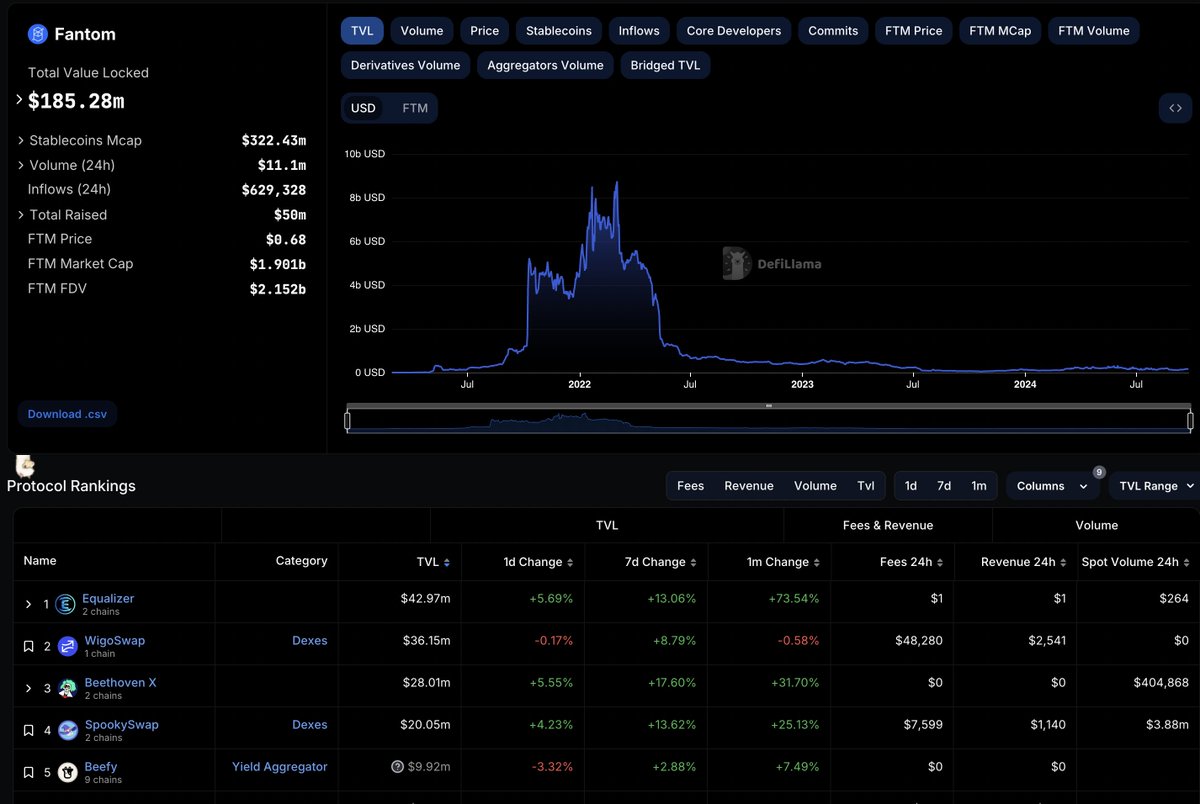

In 2022, Fantom Opera TVL peaked at $8.8B.

After the catastrophic @multichain bridge incident, which resulted in the loss of 100s of millions, the ecosystem collapsed and never recovered.

With the imminent launch of @0xSonicLabs mainnet, hype has now finally returned to the ecosystem.

Will Sonic bring back the former DeFi glory?

@RedactedRes went deep down the @0xSonicLabs rabbit hole to uncover what the hype is all about and what it means for the Fantom universe.

Keep reading for ████████ alpha on $S. ⤵️

➊ WTF is Fantom?

@FantomFDN Opera is an alt-L1 blockchain that is fully EVM compatible but provides fast finality alongside faster and cheaper execution (vs. Ethereum).

Fantom's key innovation is Lachesis, a fast, leaderless, and Byzantine Fault Tolerant (BFT) consensus mechanism.

Instead of a linear blockchain, Lachesis uses a Directed Acyclic Graph (DAG) where nodes store transactions as event blocks, which can be confirmed simultaneously.

Lachesis nodes only exchange and sync individual events. When enough nodes approve an event, it's added to the DAG and subsequently confirmed.

This structure enables Lachesis to reduce communication overhead and allows for nearly instant transaction finality.

Led by charismatic builders like @AndreCronjeTech or @danielesesta, the ecosystem was among the big winners of the alt EVM narrative, and was able to successfully bootstrap a vibrant ecosystem of applications.

Fueled by the resulting degen activity on the chain, the ecosystem grew into a Top 5 chain in terms of TVL end of 2021 / early 2022.

The downfall since then, accelerated by the @multicoin implosion and the FTX disaster, has been steep.

Even after those major events passed, Fantom continuously lost mindshare, users and liquidity to other emerging ecosystems, as L2s ($ARB, $OP, etc.) and altVM chains (see $SOL or $SUI now) took over.

Today, the excitement around EVM execution layers has in general notably cooled down.

The exceptions here are @monad_xyz, @megaeth_labs and @berachain.

What makes them unique, is that they scale the EVM to another level from what alt EVM chains are capable of today (Monad and MegaETH), innovate around novel DeFi primitives or economic models (Bera), and that they are strongly community-focused (Monad and Bera).

With @0xSonicLabs, the Fantom team aims to merge these three ideas into the ultimate "anti VC coin bet". Let us explain anon.

➋ WTF is Sonic?

Sonic is a high-performance EVM blockchain developed by @0xSonicLabs (Sonic Labs).

Built on Fantom’s architecture but with substantial upgrades, Sonic offers a secure gateway to Ethereum and achieves sub-second finality.

In the long-term the team wants to scale the chain into an entire ecosystem of execution layers, capable of handling millions of transactions daily.

The Sonic chain runs the Fantom Virtual Machine (FVM), which is fully compatible with the Ethereum Virtual Machine (EVM) but offers significantly faster performance.

With upcoming upgrades such as parallelization on the tx execution level (think Monad) in the coming months, Sonic aims to further increase its throughput.

One of the key innovations within Sonic is the introduction of the Sonic Gateway, a next-generation bridge architecture that significantly enhances security for users and decentralized applications (dApps).

This new architecture addresses some of the vulnerabilities present in existing systems, offering greater protection towards bridging risks than the current Fantom Opera network.

Another key feature of Sonic is the native gas monetization, which allows builders to earn up to 90% of the gas fees their apps generate, which is a unique incentive to build on Sonic.

In an interview a few months ago, @michaelfkong also emphasized Sonic's role as a "best-in-class decentralized sequencer" for both L1 and L2 execution layers.

According to Kong, Sonic has the potential to handle up to 180 million transactions per day with sub-second finality, which aligns with the vision of enabling Sonic-based app-specific L2s as part of a broader ecosystem strategy.

The native token of the Sonic network is $S.

Upon launch, $FTM holders will be able to exchange their tokens on a 1:1 basis for $S, onboarding existing Fantom users into the Sonic ecosystem.

$S plays various roles in the ecosystem:

➤ Paying transaction fees

➤ Running validators / delegated staking

➤ Governance voting

➤ +++

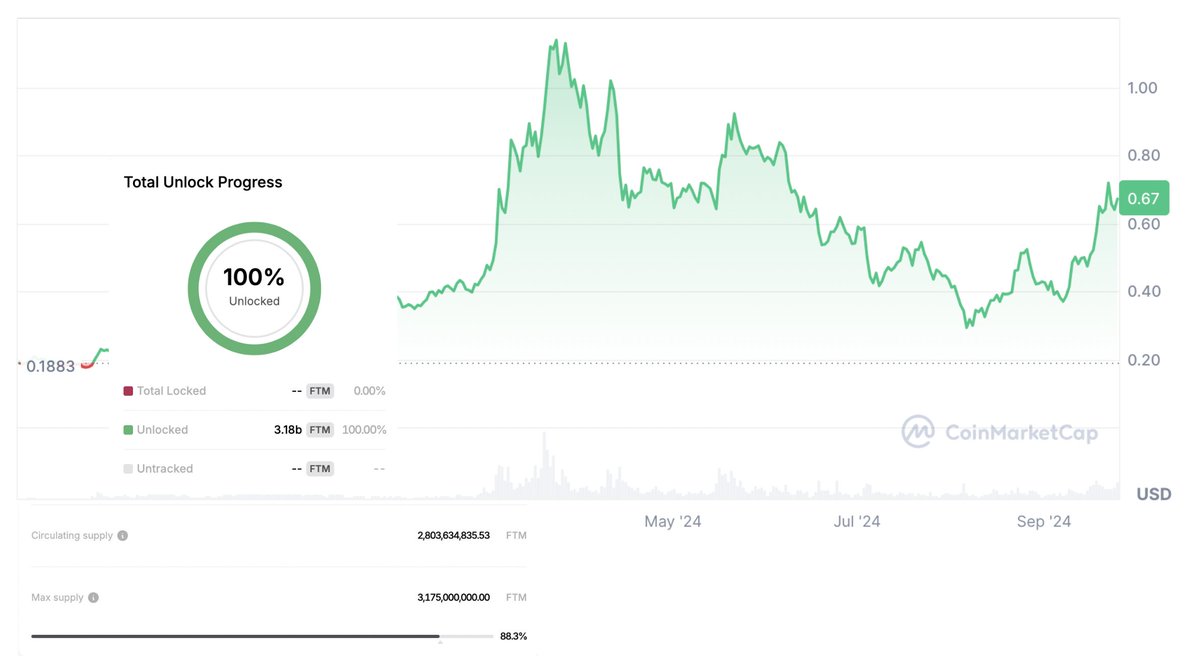

Unlike most newly launched (low float / high FDV) tokens, $FTM (soon) $S is free of what people often refer to as "predatory VC tokenomics".

$FTM has a max supply of 3,175M with all tokens unlocked and 2'800M $FTM (88%) already circulating.

Okay cool, but will there be an airdrop?

Yes anon.

Sonic Labs also plans to incentivize users through an airdrop of 190.5 million $S tokens, aimed at both existing @FantomFDN Opera users and new participants.

The incentives will focus on driving total value locked (TVL), transaction volume, and ecosystem growth.

To support sustainable development in the long-term, Sonic Labs will also mint additional $S tokens six months after launch.

These funds will be used to grow adoption, expand the development team, and implement robust marketing campaigns.

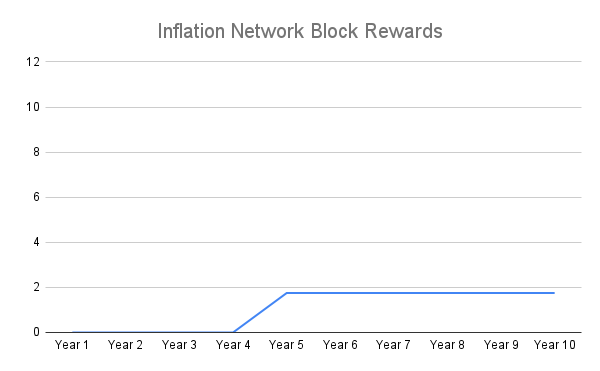

What about inflation?

In an effort to prevent inflation, unused tokens will be burned annually, ensuring that the total supply remains controlled and dedicated to network growth.

Sonic has a 3.5% target block reward rate to incentivize validators, while burning 50% of transaction fees for non-gas-monetized apps.

Thanks to the migration of $FTM block rewards to $S, the 3.5% target block reward rate is achievable without inflation in Sonic’s first four years.

At the end of this time period, new $S tokens will be minted to ensure this target rate (and the security of the network) is properly and consistently maintained.

This will lead to an overall annual inflation of roughly 1.75%.

Under the leadership of @AndreCronjeTech, Sonic’s CTO and a highly respected figure in decentralized finance (DeFi), things could get really interesting.

In his role, Cronje is currently leading the design and development of Sonic, with a focus on the new native bridge technology (Sonic Gateway).

He stated:

“𝐴 𝑠𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐸𝑡ℎ𝑒𝑟𝑒𝑢𝑚 𝐿2 𝑛𝑒𝑒𝑑𝑠 𝑐𝑜𝑛𝑓𝑖𝑟𝑚𝑎𝑡𝑖𝑜𝑛 𝑜𝑛 𝐸𝑇𝐻 + 𝑢𝑠𝑢𝑎𝑙 𝑓𝑟𝑎𝑢𝑑-𝑝𝑟𝑜𝑜𝑓 𝑡𝑖𝑚𝑒. 𝑂𝑛 𝑆𝑜𝑛𝑖𝑐, 𝑎𝑠 𝑎𝑛 𝐿1 (𝑚𝑜𝑟𝑒 𝑖𝑚𝑝𝑜𝑟𝑡𝑎𝑛𝑡𝑙𝑦 𝑎𝑛 𝑎𝐵𝐹𝑇 𝐿1), 𝑜𝑛𝑙𝑦 𝑐𝑜𝑛𝑠𝑒𝑛𝑠𝑢𝑠 𝑎𝑝𝑝𝑟𝑜𝑣𝑎𝑙 𝑖𝑠 𝑟𝑒𝑞𝑢𝑖𝑟𝑒𝑑 (𝑠𝑢𝑏-𝑠𝑒𝑐𝑜𝑛𝑑 𝑓𝑖𝑛𝑎𝑙𝑖𝑡𝑦) 𝑓𝑜𝑟 𝑐𝑜𝑛𝑓𝑖𝑟𝑚𝑎𝑡𝑖𝑜𝑛. 𝑇ℎ𝑒𝑟𝑒 𝑖𝑠 𝑎𝑙𝑠𝑜 𝑛𝑜 ‘𝑙𝑜𝑛𝑔𝑒𝑠𝑡 𝑐ℎ𝑎𝑖𝑛 𝑟𝑢𝑙𝑒’ 𝑖𝑛 𝑒𝑓𝑓𝑒𝑐𝑡, 𝑤ℎ𝑖𝑐ℎ 𝑒𝑙𝑖𝑚𝑖𝑛𝑎𝑡𝑒𝑠 𝑡ℎ𝑒 𝑛𝑒𝑒𝑑 𝑓𝑜𝑟 𝑎𝑛𝑦 𝐶𝐸𝑋 𝑑𝑒𝑝𝑜𝑠𝑖𝑡 𝑝𝑟𝑜𝑚𝑝𝑡 𝑜𝑓 ‘𝑤𝑎𝑖𝑡𝑖𝑛𝑔 𝑜𝑛 10 𝑐𝑜𝑛𝑓𝑖𝑟𝑚𝑎𝑡𝑖𝑜𝑛𝑠…’, 𝑒𝑡𝑐. 𝑊𝑖𝑡ℎ 𝑆𝑜𝑛𝑖𝑐, 𝑜𝑛𝑙𝑦 1 𝑐𝑜𝑛𝑓𝑖𝑟𝑚𝑎𝑡𝑖𝑜𝑛 𝑖𝑠 𝑟𝑒𝑞𝑢𝑖𝑟𝑒𝑑 𝑓𝑜𝑟 𝑎 ‘𝑓𝑖𝑛𝑎𝑙𝑖𝑧𝑒𝑑’ 𝑡𝑟𝑎𝑛𝑠𝑎𝑐𝑡𝑖𝑜𝑛. 𝐿𝑖𝑘𝑒 𝑎 𝑡𝑟𝑢𝑒 ‘𝑓𝑖𝑟𝑠𝑡-𝑐𝑙𝑎𝑠𝑠 𝑐𝑖𝑡𝑖𝑧𝑒𝑛’, 𝑆𝑜𝑛𝑖𝑐 𝐺𝑎𝑡𝑒𝑤𝑎𝑦 ℎ𝑎𝑠 𝑎 𝑓𝑎𝑖𝑙𝑠𝑎𝑓𝑒 𝑤ℎ𝑒𝑟𝑒 𝑢𝑠𝑒𝑟𝑠 𝑐𝑎𝑛 𝑟𝑒𝑐𝑜𝑣𝑒𝑟 𝑡ℎ𝑒𝑖𝑟 𝑓𝑢𝑛𝑑𝑠 𝑜𝑛 𝑡ℎ𝑒 𝑐ℎ𝑎𝑖𝑛 𝑡ℎ𝑒𝑦 𝑏𝑟𝑖𝑑𝑔𝑒𝑑 𝑓𝑟𝑜𝑚.”

Aside this, @AndreCronjeTech is also looking to introduce novel DeFi primitives to Sonic.

One of the most groundbreaking ones is the native credit score integration, which targets the $11.3 trillion unsecured lending market.

By extracting and transforming blockchain data, the Sonic team, led by Cronje, has developed a privacy-focused credit scoring system that doesn’t require KYC or personal identifiable information (PII).

This innovation opens the door to decentralized, unsecured lending on a massive scale, providing users with access to credit while preserving their privacy.

In recent Twitter posts, Cronje has also hinted at other primitives which will exclusively be launched on @0xSonicLabs.

➌ The Path from Fantom to Sonic

The Sonic network is currently in testnet and the launch of mainnet is expected by end of the year, which will also mean that $FTM holders can migrate their tokens to $S.

@0xSonicLabs has been showcasing exceptionally strong numbers on the testnet, both in terms of user activity as well as performance.

With consistently sub-second block-time and finality, Sonic is shaping up to be the first "next-gen" EVM alt L1 that makes it to market, essentially front-running other players like the before mentioned Monad (even though technologically different).

While Sonic Labs will continue to support Fantom Opera for the time being, validator rewards will be migrated to the new Sonic chain, and as validators and user migrate, the transition will be complete.

What about applications?

@0xSonicLabs has recently launched Sonic Boom, a developer program that offers significant $S incentives to build on Sonic.

Since the chain is fully EVM compatible, it will likely be easy for many apps from other EVM chains to migrate and/or expand to Sonic too.

Most Fantom Opera (OG) protocols have already officially announced that they will be deploying on Sonic.

This includes:

- @beethoven_x (DEX & Liquid Staking)

- @Equalizer0x (DEX & Derivatives)

- @TarotFinance (Lending)

- @polterfinance (Lending)

- @SpookySwap (DEX)

- @mummyftmfi (Perp DEX)

- @Lynx_Protocol (Perp DEX)

- @WigoSwap (DEX)

- @worldofumans (NFT Collections)

- @SilverSwapDex (DEX)

- @paint_swap (NFT Marketplace)

- @ShadowDexFi (DEX)

- @fMoneyMarkets (Lending)

- +++

➍ ████████ Conclusion

@0xSonicLabs undoubtedly set out on an ambitious mission.

The competition in the market is fiercer than ever and many doubt that the EVM L1 narrative can still succeed amid Ethereum's rollup-centric roadmap (also don't forget Celestia & co) and innovation around altVMs.

Especially @solana has been very successful in establishing itself as a major DeFi ecosystem with significant adoption and activity, while Move-based chains like @Aptos or @SuiNetwork have also been garnering mindshare.

Considering the hype around @monad_xyz, @berachain and @megaeth_labs (loading), it seems though as if there is still a narrative and some interest.

Amid the still persistent dominance of Solidity in terms of value secured per programming language and the large talent pool the EVM has, that is hardly surprising.

However, as mentioned earlier in this post, there is also other elements that can be crucial in defining a project's success.

That includes community and ecosystem, both of which are things that teams have to consistently and actively work on.

@berachain for example introduces novel mechanics such as a bribery system or PoL, and strongly activates the community (through strongly meme-driven positioning), which gives it an edge on attracting both builders and users vs. many other ecosystems.

While also being strong on the community side, @monad_xyz adds technical supremacy and unlimited scale to the mix, which once again makes for an interesting mix wrt bootstrapping a healthy ecosystem.

Incentives, both for users (airdrops) and builders (gas monetization, dev programs, etc) are also key, and once again an area where all of the above mentioned projects excel.

Now what does that mean for @0xSonicLabs (aside tough competition)?

Sonic benefits from the fact that it has an existing ecosystem of builders and users to tap into. While it remains to be seen how successful the activation of that eco is in the end, so far it looks very promising.

Combined with the USP of not being "a low float / high FDV coin to make VCs rich", that puts Sonic in a unique position vs. its competitors.

However, that likely won't suffice to maintain mindshare and relevance in the long term.

With its quite degen/memetic positioning and novel builder incentives and DeFi primitives (the @berachain way), as well as bringing massive scale to the EVM (the @monad_xyz way), alongside well thought-through incentive mechanisms (Sonic Boom + airdrop), Sonic does however have a clear plan of making it happen.

It will definitely be interesting to see how @0xSonicLabs evolves from here, and if the ecosystem returns to the former $FTM DeFi glory in the months to come.

⚠️ This is not financial advice and the report is NOT sponsored by any third-party.

19

8.62K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.