Many have asked me in DMs which RWAs to invest in.

I believe there is a significant lack of education on what’s out there.

Here are 4 RWA protocols you should know about:

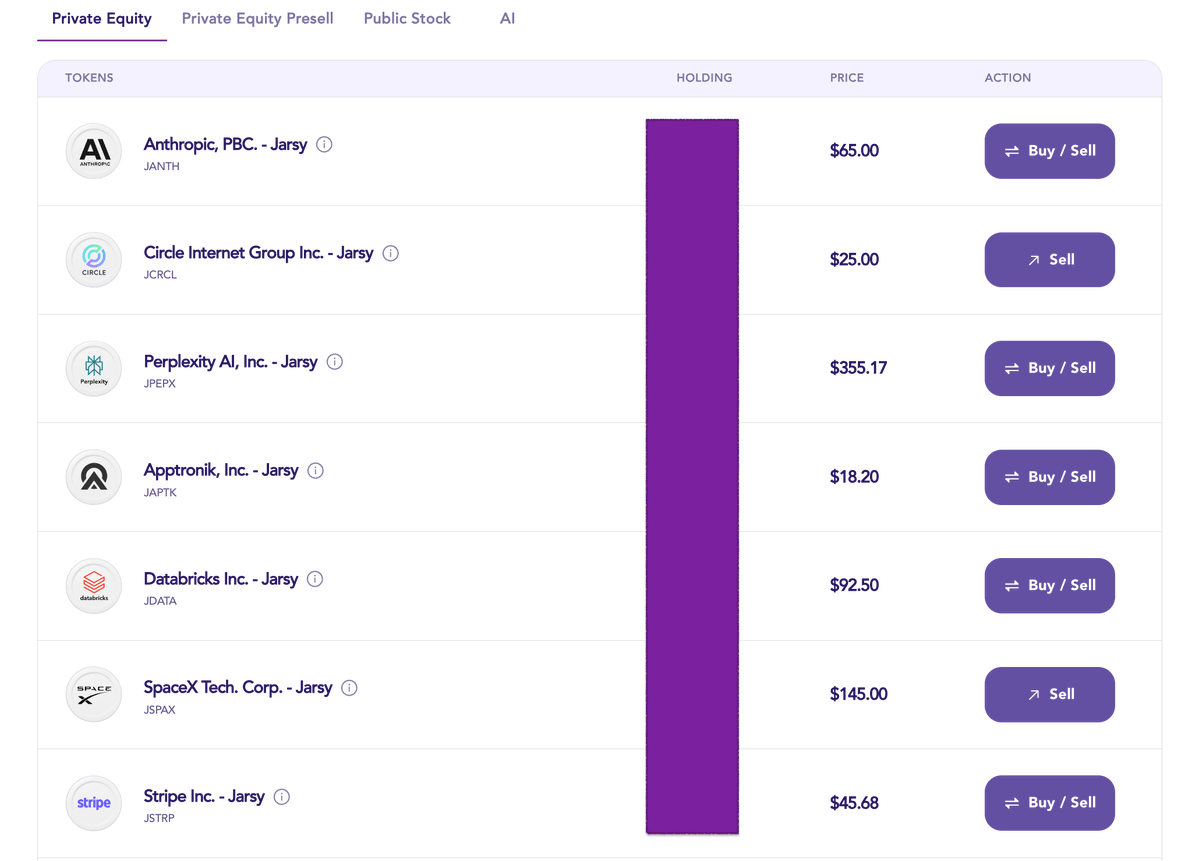

1.) @JarsyInc

Everyone is bullish on Robotics.

Every day, I come across people investing in the sector or new startups raising massive funding rounds.

However, most of us don't have access to these deals.

And that's where Jarsy comes in. The app lets anyone invest in both public and private equities, including the AI, robotics, fintechs, and so on.

Here are the companies available:

AI & Robotics:

• @AnthropicAI

• @Figure_robot

• @perplexity_ai

• @Apptronik

• @databricks

Fintechs & Crypto:

• @circle

• @krakenfx

• @stripe

• @Ripple

Other Sectors:

• @SpaceX

• @discord

• @anduriltech

• @RedwoodMat

Note that you need to KYC before starting to invest in these companies.

2.) @humafinance

You might have heard about PayFi, a new term that refers to unlocking idle capital in traditional payment systems by leveraging DeFi and tokenization to settle payments instantly.

Imagine DeFi protocols, infrastructure providers, and TradFi institutions working together to enable instant payments, new forms of financing, and several innovations across remittances, capital deployment, payroll, and more.

One of the leaders in this emerging vertical is Huma, a protocol that enables enterprises to settle payments using stablecoins and on-chain liquidity.

In April, Huma launched a permissionless version of its app, allowing anyone to participate in its pools and support the system.

Businesses pay fees to use Huma for cross-border payments. A portion of those fees is redistributed to users who provide liquidity. You can participate in two ways:

• Classic Mode: Mix of stable yield (currently ~10.5% APY) and Huma rewards

• Maxi Mode: Boosted Huma rewards, but no stable yield

While Maxi Mode may seem less attractive due to the lack of yield, it could be a good move in the short term, as the $HUMA token is launching soon.

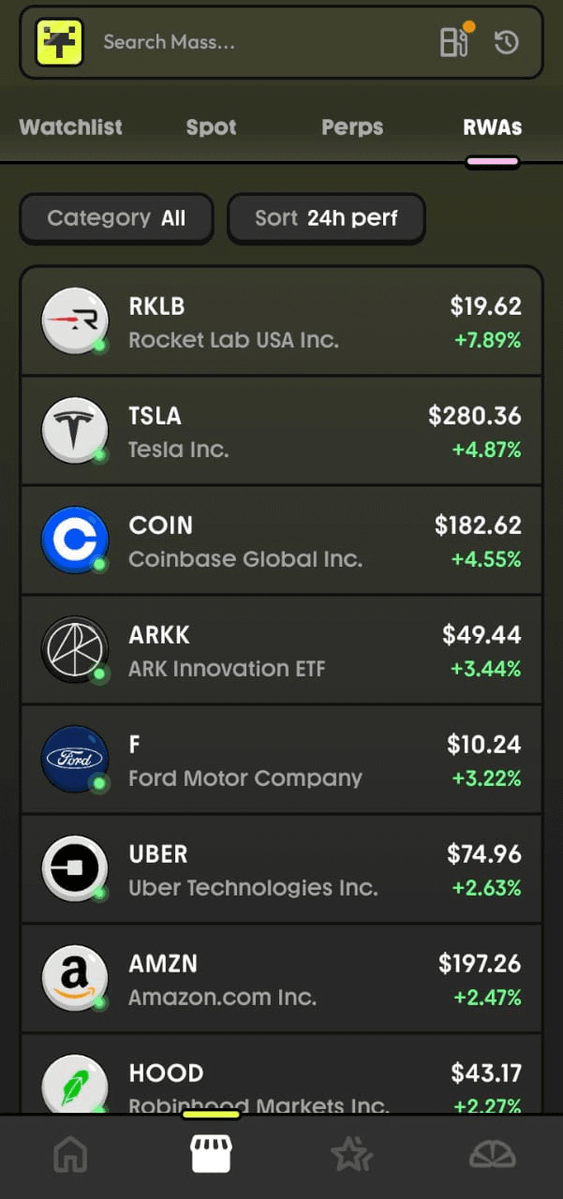

3.) @massdotmoney

Another platform offering onchain equities is Mass, which leverages @DinariGlobal’s infrastructure to bring hundreds of U.S. public stocks in a super user-friendly mobile app.

The app is available only on IOS and Android and features perps and crypto spot products as well. Aside from the product offering, the whole UX is gamified with daily spins and tasks that reward active users with $MASS tokens.

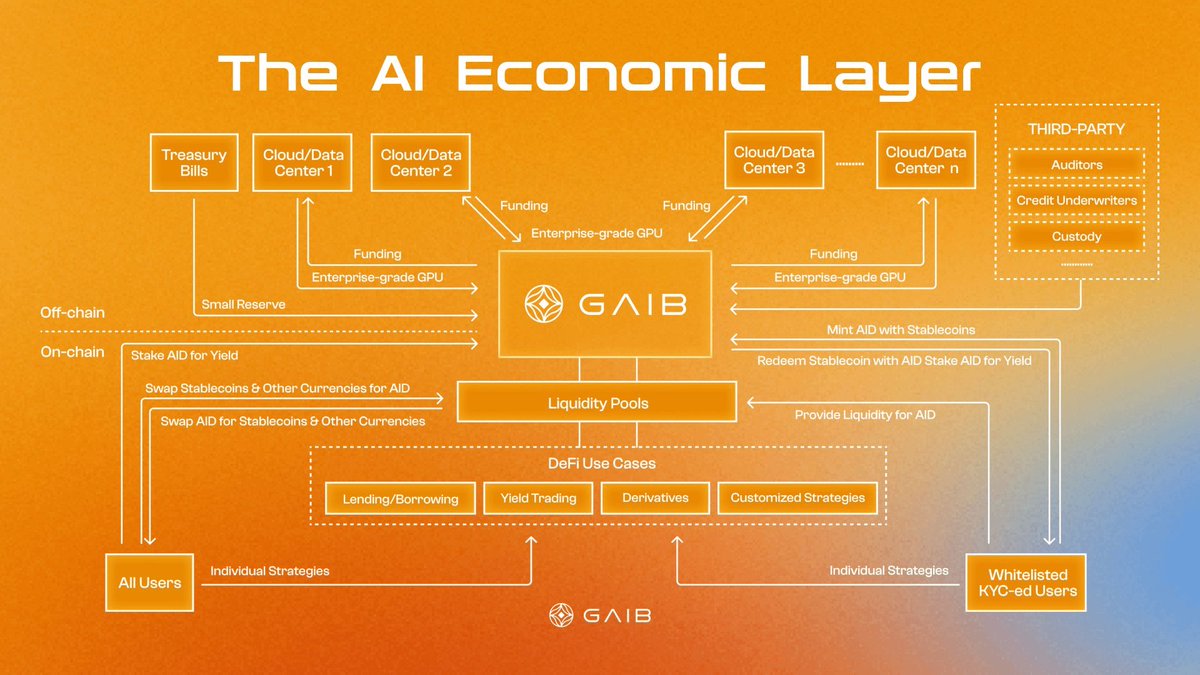

4.) @gaib_ai

Last but not least, you should check out Gaib, a project focused on tokenizing and financializing GPUs.

Gaib tokenizes GPU deals and builds products on top of them. One such product is $AID, a synthetic dollar backed by a portfolio of GPU financing deals and U.S. t-bills.

In simple terms, GAIB turns computing into a productive asset, unlocking liquidity for AI infrastructure and increasing access in the sector for retail participants.

The first pre-deposit round for $AID raised $5M, with a second round coming very soon.

Ultimately, none of this is financial advice and I’m not paid or affiliated with any of the projects mentioned. Just sharing what I find interesting and personally utilize.

Show original

52

41.33K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.