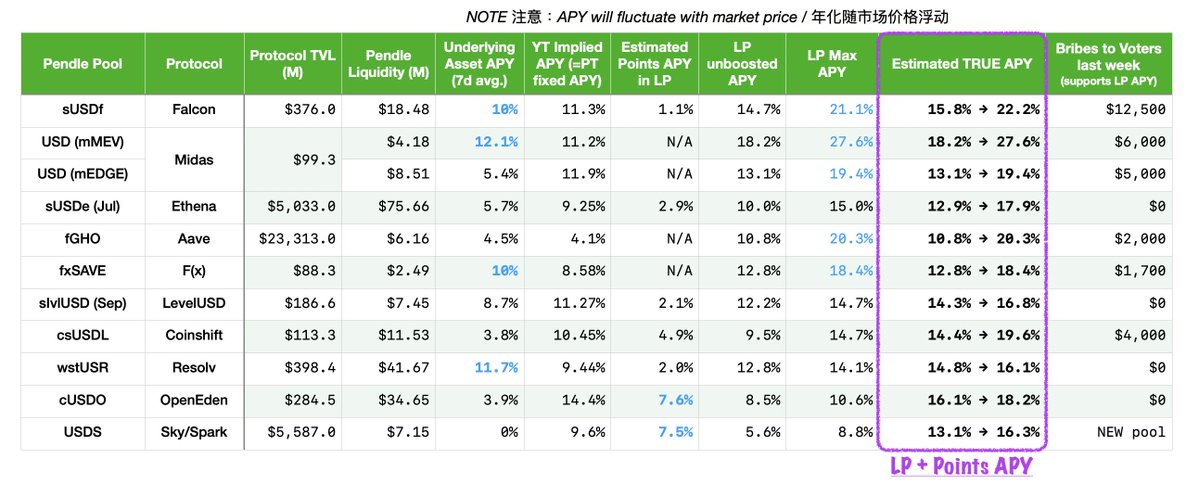

[Bookmark 🔖] @pendle_fi How to choose dozens of stablecoin LP pools? Don't know the project? What are the ones that ViNc is digging?

Select Pendle's pools with considerable annualization, good depth, and sustainable annualization, and it is best to have high-quality points bonuses, suitable for friends who want to make steady profits and want to participate in the white prostitution airdrop!

🧵 Disassemble them one by one

sUSDf、sUSDe、USD(Midas)、fGHO、fxSAVE、slvlUSD、csUSDL、wstUSR、cUSDO、USDS

… sUSDe (July)

For Ethena's points valuation and strategy, you can refer to a previous post on ViNc:

Ethena S3 Review | S4 Outlook | sENA Raiders】

@ethena_labs Season 3 airdrop, 27T points shared 3.5%, or $164.5M of $ENA, or $6.1 per 1M points

Based on the previous @pendle_fi $USDe pool's 50x points, you can mine $0.03 airdrop or 11.1% APR 💰 for every 100 $USDe of points per day without additional boost or bonus

During the period, the annualized rate of Pendle LP is about 10-20%, and the overall annualized rate is about 30%, which is not bad in terms of stablecoin income... It's a pity that the price of $ENA ended up at a low level, otherwise the annualized points would not stop there

✤ ✤ ✤

Looking forward to the fourth quarter, based on the accumulation rate of points in the first month plus a certain amount of space, it is expected that the final points will be 40T and share at least 3.5% of the airdrop (Ethena has stated that the distribution of S4 will not be less than S3), that is, $4.1 per 1M points (based on the current price of $ENA)

Based on the latest Pendle $USDe pool of 60x points, without additional boost or bonus, i.e. $0.0246 airdrop or 9% APR can be mined for every 100 $USDe of points per day

You can consider the opportunities in LP / PT / YT according to their respective outlook $ENA price outlook, TVL growth, etc

✤ ✤ ✤

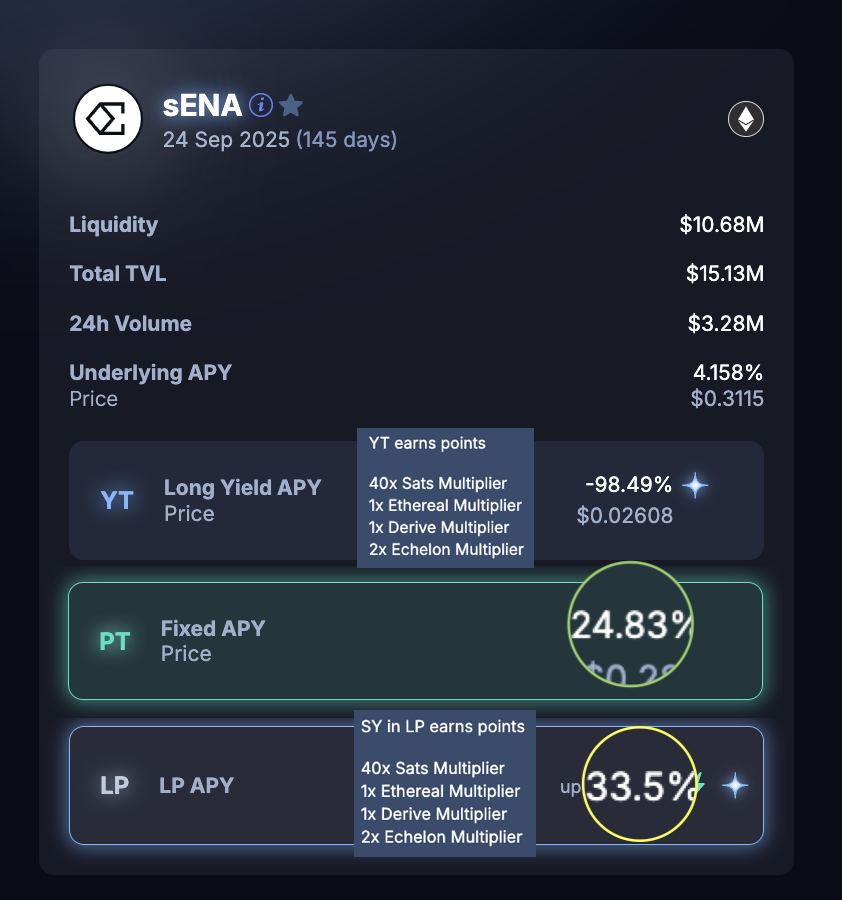

As for the $sENA you get, if you don't want to cut it at a low price, you can consider depositing it in the @pendle_fi sENA pool, in addition to 40x Ethena Sats points and other sub-project points, the current APR is 33% annualized and PT is 25% annualized

YT/LP's sENA can be used to boost USDe or sUSDe (or related LP/YT) points, please refer to the following strategy for details...

✤ ✤ ✤

"Ethena Points Newcomer Strategy"

If you haven't signed up for the program yet, you can use the My Invitations link

If you have registered, the page above will show you the points multiplier in different places

Generally speaking, it is better to deposit Pendle multiples: about 30-60x, depending on the expiration date, etc. (there is a list of multiples in the Ethena link above)

◆ PT does not have points, only earns a fixed u income

◆ The concept of YT is similar to paying a fixed interest expense in advance, borrowing funds to deleverage and dig up the underlying income & points

◆ 1 PT will be refunded at maturity with 1 USDe worth (redeem USDe or sUSDe tokens equivalent)

◆ 1 YT is equivalent to depositing 1 USDe into USDe or sUSDe

✤ ✤ ✤

As for LP, LP = PT + SY (SY you should be the underlying asset, here is USDe or sUSDe), the ratio can be floating, and the PT content in LP is higher when YT is more popular. LP can be seen as a relatively neutral strategy, earning both PT and points

✤ ✤ ✤

USDe has a higher multiplier and sUSDe is half as low. But in the case of $sUSDE, in addition to the points, there is also the underlying APY of the underlying income itself (currently 4-5%)

Note: The $eUSDe of the Ethena ecosystem project @etherealdex is basically the same as that of $USDe, and eUSDe is a 1:1 package of USDe

Another benefit of the USDe (or eUSDe) Pendle pool is the airdrop that the pool has mined, and Ethena has promised not to lock up

✤ ✤ ✤

Finally, there is $sENA or YT-sENA or LP-sENA (the SY part of LP), which has 40x Ethena points in addition to Ethereal (Ethena's own Perp DEX) and other Ethena-related sub-projects

It can also be used to boost your points 🚀 on Ethena's USDe/sUSDe class positions (including YT).

For example, if you have 6000 YT-sENA, let's say $ENA = $0.333

Rule:

◆100% boost for USDe or sUSDe points of $2000 or less (i.e. x2)

◆60% boost (i.e. x1.6) for $3000 USDe or sUSDe points (2000/3000 rounded up to whole number)

◆30% boost (i.e. x1.3) for $6000 USDe or sUSDe points (2000/6000 rounded up to whole number)

◆ If the boost is less than 20%, it is no longer applicable

The same applies to Pendle-associated LP/YT sites

It can be seen that in addition to the LP/YT of sENA itself, if it is properly coordinated, it can also double the credit income of the stablecoin at most

ENDS 🔚🙏

🟢 $USDS

Issuer: Spark (@sparkdotfi), Sky ecological sub-DAO, TVL about $5.7B. USDS has an issuance size of $3.5B, which is already the first stablecoin

Mechanism: $USDS is an upgraded version of $DAI, which is a CDP decentralized stablecoin with revenue from the D3M module, and the current Saving Rate is 4.5%

For a detailed introduction to Spark Credits, please see the post the day before yesterday:

1/ Pendle x Spark Collaboration Launched! 🔥 The $USDS pool (expiring in August) is now available in @pendle_fi

Spark🎆 Points Season 1: The only Pendle-exclusive event right now... Don't shout if you miss it, @Vinc2453 take you straight to the alpha!

First of all, let's figure out what @sparkdotfi and Spark Point are, and some friends said that the income from the points pool depends on 100+% 🤔 to see how big 👀 the opportunity is

🧵

115

47.15K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.