Others are involved in the handling fee, he is building a bridge of trust: Brother Sun is one step ahead?

At first people thought it was an ordinary collaboration...... Not long ago, TRON officially announced that it will officially integrate Chainlink decentralized oracles as a standard data source. This is not the first time that TRON has proposed oracles, nor is it the first time that TRON has engaged in a data feed system. But this time it's different, and it brings a real trust upgrade!

Why Chainlink?

Those who are familiar with TRON know that officials have previously promoted their own WINkLink as a data source. But standing at the height of today's ecology - USDD, JustLend, SunSwap, RWA and the upcoming USD1, the more assets on the chain, the more complex the gameplay, and the higher the requirements for the price feed system.

Chainlink is the industry's most mature decentralized oracle system, and data is resistant to manipulation and downtime without relying on a single point or escrow. What's more, it's already the industry standard adopted by most major DeFi platforms. This step of TRON is actually in line with the mainstream and the core trust logic of DeFi.

In other words, from now on, the lending, stablecoin, and LP market-making systems on the TRON chain have a complete set of data guarantees that can stand the verification of the market.

Absorb 13 billion TRX in six days, and the funds are voting

The first wave of feedback from technology upgrades is the response of funds.

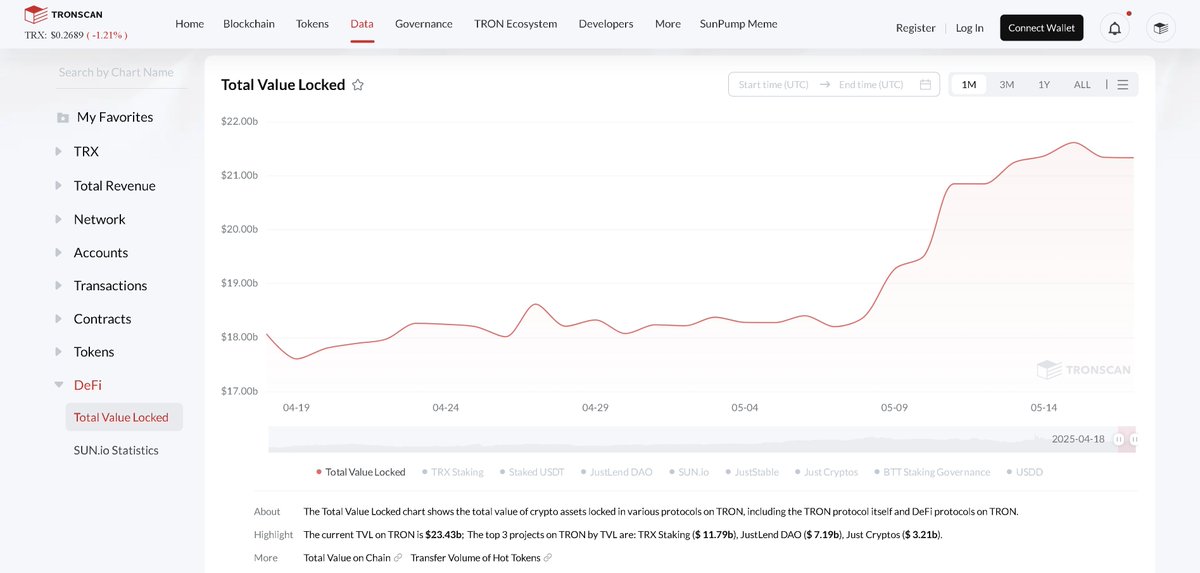

According to Tronscan data, TRON TVL soared from about $18 billion to $21.6 billion between May 8 and 15, a surge of $3.6 billion in seven days, equivalent to a net inflow of more than 13 billion TRX at the TRX price at the time.

This is not speculation, but a long-term lock-in of real money. The premise that users are willing to lock up their money on JustLend and Sun io is because they believe that this system will not suddenly blow up due to data errors and price feed problems. Chainlink solves this fundamental trust problem.

This wave of funds entering the market is not only liquidity, but also a vote of confidence.

From stablecoins to RWA, TRON is polishing the bridge between on-chain and reality

This integration has another stealth effect: it opens the door to the RWA market for TRON.

The biggest threshold of RWA is not to issue chains or coins, but to reliably map the price, state, and security of the real world to the chain.

Chainlink is currently the world's most important RWA data transmission infrastructure. Most of the tokenized U.S. bonds, tokenized real estate, and tokenized gold you see rely on it to provide price and status updates.

Therefore, when TRON wins Chainlink, it means that in the future, if you want to run tokenized US Treasury and tokenized real estate, it will no longer be on paper, but technically ready to go~

A low-key but critical infrastructure upgrade

In this era when DeFi is getting closer and closer to reality, TRON's action this time may have a more far-reaching impact than an additional issuance of USDT and a marketing airdrop. For TRON to become the main front for real-world assets on the chain, it is not enough to rely on the number of users and high-frequency trading. Connecting to Chainlink is a key step in the trust puzzle.

I have to say that Brother Sun's vision is still ahead of most people. Others are still rolling fees and TVL, and he is already laying the trust foundation of the next generation of on-chain finance.

You can not look at the candlestick of the TRX

But he bets in the direction

It's definitely worth a look for everyone!

@justinsuntron @trondaoCN #TRONEcoStar

Show original

22.31K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.