It's going to be another massive week for crypto.

To help you prepare, I compiled the top 10 alpha tweets I bookmarked over the past few days.👇

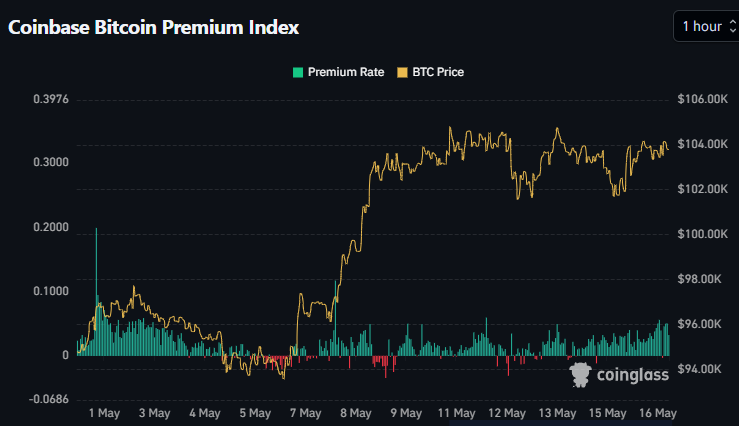

1. Coinbase's spot premium has held steady throughout the latest surge. $BTC has been rallying with minimal leverage buildup compared to past runs to ATH.

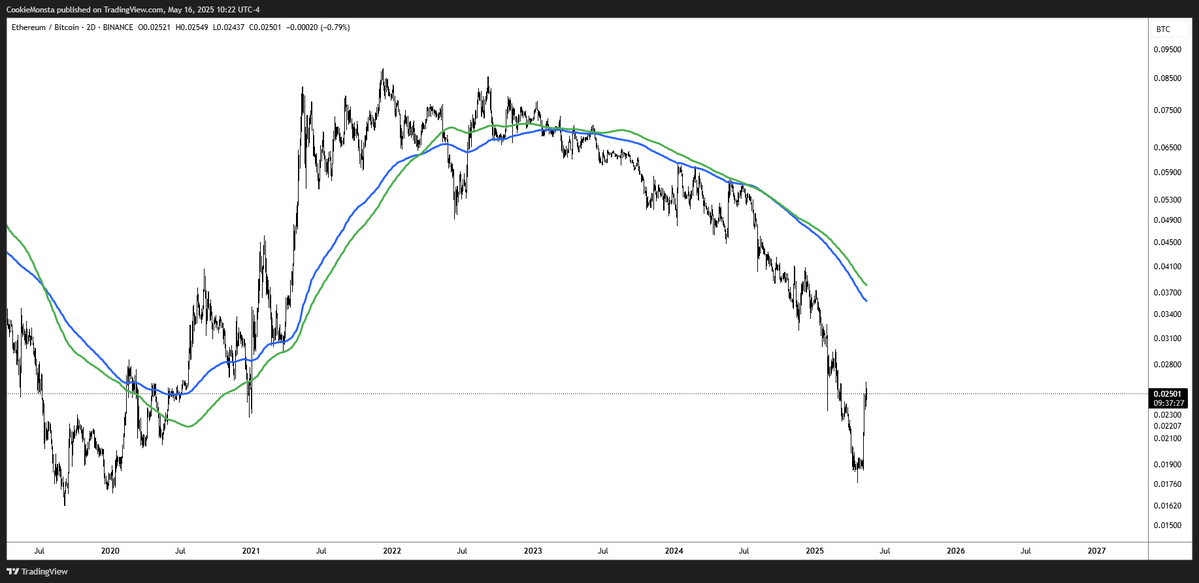

2. When $ETH shows strength, so do altcoins.

like it or not, $ETH is still the king of altcoins

which means alts across the board will generally all show strength whenever ETH is able to show strength

this is why we have not seen a proper 'Alt-SZN' the past 2.5 years, and it's been much more rotational into mini-sectors

you've seen the reaction of the altcoin market when $ETH manages to pop just recently; this is what the chart still looks like and yet there are more opportunities out there at the moment than what you can catch

imagine what things will look like when this trend successfully shifts for the first time in years

and then, you have to remind yourself: that's the event you're truly here for

the easiest of easy modes.

the best way to ensure you miss it, whenever it happens, is by sulking about opportunities missed leading up to it

big picture things. opportunity is abundant.

3. $ETH pumping allows all altcoin valuations to be repriced towards the upside.

4. "Internet capital markets" took crypto by storm this past week.

internet capital markets — do you want to be right, or make money?

imo the thesis is simple.

you’ve got the solana foundation and multicoin pushing this meta hard — publishing research, shaping the narrative, and bringing on @nikitabier to help solana break out with viral, mobile-native consumer apps.

@believeapp sits squarely at the intersection:

- on one side, democratizing capital markets;

- on the other, onboarding web2 talent and consumers with a mobile-first model.

it’s still early — and a lot of this may not be sustainable — but right now, the app is printing.

over $5M in protocol revenue in the past 24h, with another $5M paid out to creators.

for reference, virtuals peaked at just over $1M/day during its run to a $5B market cap in january.

already emerging as the clear leader — both in adoption and price action (up 20x in a few days to a ~$300M mcap) — and with nikita publicly backing its early success, $launchcoin still feels like the best way to play this trend.

especially given the reflexive flywheel it’s built around:

rev share → more creators join

better creators → better launches

better launches → more users + volume

more volume → more revenue

more revenue → stronger fundamentals

stronger fundamentals → price goes up

→ repeat.

//

if you missed the first leg on $launchcoin, tracking new launches for long-tail beta makes sense.

but at this stage, i’d still rather own the house — where the coins are being launched, the value is accruing, and the users are onboarding at scale.

rotations are fast. nothing especially compelling has launched yet. and solana’s biggest players — including nikita — are publicly backing the narrative and acknowledging believe’s early traction.

@pasternak also feels like a far more competent founder than most of what we saw during the agent meta earlier this cycle.

and relative to peak valuations — $zerebro at $750M, $goat at $1.3B, $ai16z at $2.4B, $virtual at $5B — $launchcoin still looks early at ~$300M.

higher.

5. Ground rules for playing a new meta.

Playing this metas, a few starter rules:

1) Don’t marry your bags - unless it’s official with real utility, network effects, or a ponzi strong enough to keep people hooked.

2) Attention rotates fast - cheaper, shinier coins steal focus. What’s loved today is bagged tomorrow.

3) If you’re late, rotate - don’t chase tops. Either play what’s next, or scale in on dips if you truly believe. That way, you don’t miss, but you don’t chase either.

6. Another emerging meta that has caught my interest.

My complete modular HyperEVM farming blueprint:

Been deep in hEVM for months & got DMs on what my strategy was. So here’s my full framework. No alpha gatekeeping. Just what’s working for me.

I personally mix all these approaches depending on market conditions.

I've rated each strategy on an "offensive scale"

(0% = super safe, 100% = full degen mode).

I painted this graph so it helps you build your own strategy. I share mine, but use it flexibly to design what fits you best.

💧 Strategy A: The Safety Net (20% Offensive)

This is my go-to when I want steady yields with minimal risk. I split it like this:

> I deposit 20% of my stack on @sentimentxyz from which ½ goes in a leveraged position. The other ½, I borrow wHYPE against wstHYPE that I've swapped on @ValantisLabs.

> Then with the borrowed wHYPE, I split it in 2 and lend on Hyperlend and @hypurrfi for more HYPE again.

>Finally, I take that fresh HYPE and deposit it on @ValantisLabs to complete the loop. Or you can also deposit some in the @harmonixfi testnet HYPE vault, which is currently capped to only 30 HYPE.

Why this works: Low risk of liquidation while still earning solid yields. Perfect entry point if you're looking to earn some yield on your HYPE or just want to sleep well at night.

💧 Strategy B: The Balanced Approach (N/A% Offensive)

This is where I put 80% of my capital - balancing decent yields with manageable risk:

> A little over ½ goes on @felixprotocol stable farm, which I mint feUSD with a health factor > 2.5. Always monitor the redemption rate too. (learned the hard way.)

Since they've launched the vanilla market, I'm now depositing some HYPE for USDe as well.

> The other portion went on @hyperlendx from which I borrowed $HYPE that I deposited on @0xHyperBeat. Really bullish on this one, the recent surge in TVL is crazy, and imo the team is solid, love the way they manage their business. Recntly increased my allocation by depositing in the USDT0 vault.

What I'm seeing: This strategy is to me the base that allows me to leverage HYPE all over the whole ecosystem, as you can see in the graphic.

💧 Strategy C: The Degen Plays (75% Offensive)

NGL, this is the fun part. I only use about 15% of my capital here. Here you use your stables and go long on other assets (or just more HYPE)

> So, I bought some HYPE with the borrowed stables, sent very few on @HanaNetwork, bought some keys on @fanappX (a project that I like and find underrated). Team is building a better friendtech version, and community is big time sleeping on it. Early users are being rewarded. Cant wait for the trading feature to be deployed.

> Never been a solid trencher, I still sent some HYPE on @LiquidLaunchHL. As a big liquidswap bull, I bought a nice bag of $LIQD the best Hyperliquid beta imo.

> Since @okto_web3 integrated the Hypezone, I opened a new wallet onto which i sent some $HYPE and explore the dapp. Gotta admit, the wallet is easy to use and brought me to discover @LiquinaHL, a project i wasn't really familiar with.

>Made some good money on @harborfinance_ as well, that allowed me to pay back many of my loans.

>For the NFT degens, you can also buy them on @DripTrade or even @LootLiquid once they launch.

Real talk: This strategy is really for the ones who like to gamble. It has been the source of my biggest wins lately. You could also send some stables on @okto_web3 or @HyperliquidX and open some trades too.

💧 Strategy D: The Stablecoin Maximizer (5% Offensive)

When I want to play it safer but still earn solid yields:

>With the remaining stables, I provided a lot in LPs during the DEX farming season and lately to the USDE/feUSD on @CurveFinance. Also deposited a good amount in the USDT0 vault on @0xHyperBeat.

>Sent also a bunch on HLP and @harmonixfi on which you can benefit from 15% apy on your USDC. But overall, can't wait to deposit some stables whenever @liminalmoney sends out more ref codes.

>Been testing @hyperdrivedefi on testnet, waiting for mainnet to boost my HLP allocation - to consistently get 10-30% on stables on autopilot.

Bonus move: I'm also farming @hyperunit by bridging some BTC and ETH on hypercore. Lately been enjoying depositing some uETH on @KeikoFinance to maximize my farming options with ETH on hyperEVM.

What's your HYPE farming strategy looking like?

Drop it below and let's compare. Always looking for new alpha. My dms are always open.

NFA. DYOR and adapt to your own risk tolerance. Any strategy can go to 0 if shit hits the fan.

7. The importance of playing the long game as it pertains to crypto investing.

if you're trying to trade this market, AND participate in other, more lucrative sectors of crypto: memecoins, farming airdrops, Ordinals/NFTs, etc., you need to have the right mindset.

I think about it as: Primary vs. Secondary.

my primary focus is on the sector of the market where my strengths shine best; that is inherently where I'm going to have more confidence and therefore be able to justify larger risk amounts on 'High-conviction setups'. it's also where a majority of my gains will be made

but this industry is far too lucrative to confine ourselves to one sector of the market

I still want to participate in the airdrops, NFTs, and memes, but I can't justify going too heavy with risk because it's outside my range of skills / knowledge

so I allocate 'gamble bag' position sizes to those secondary plays

eventually what happens is: after a couple years, you've compounded your portfolio so much to the point where your 'degenerate gamble bags' become the same size as what your 'high-conviction plays' were a few years ago

from a linear standpoint, the $ amount of your 'gamble bags' may have increased 10x since then

but from a % standpoint, it remains the same as what it has always been, relative to your portfolio

experiencing this over the past few years has been very vindicating

you'd be surprised what you may accomplish when you play the long-game, and allow yourself the grace to succeed

8. Entering a trade is easy, sticking with it is the challenge (yet the most rewarding part.

Most traders associate patience with waiting for the right setup. But that’s only the first step.

The more difficult kind of patience, and the one that separates good outcomes from great ones - is the patience required after entering a trade.

Once a position is on, emotions often take over. The temptation to act, to protect, to optimise, to rotate - increases. The longer nothing happens, the more discomfort builds.

This isn’t about discipline in the conventional sense. It’s about managing the psychological burden of uncertainty.

You don’t know if you're early, wrong, or simply too impatient. That ambiguity wears on you.

But here’s what’s often missed: The best trades are rarely obvious when you're in them

They usually require enduring periods of boredom, doubt, or underperformance. Sitting through that - without flinching, demands more mental strength than people realise.

Many cut winners early because they can't tolerate the unknown. They prefer certainty, even if it means leaving money on the table.

But if you want to capture the full value of a good trade, you need to recognise that patience isn’t passive. It’s a conscious decision not to act when everything in your psychology is pushing you toward action.

9. Degeneracy can be your greatest ally, but also your greatest enemy.

Picture a high-stakes gambler who hits it big at the roulette table, walking away with millions. But instead of stopping, the thrill of the game keeps pulling him back.

The money isn’t the goal, the rush is. No matter how much he wins, he’s still a gambler at heart, always chasing the next high, never satisfied.

In crypto, the same pattern emerges. You might turn a small stack into eight figures through wild bets, meme coins, and high-leverage trades. But the mindset that got you there, the constant risk-taking, the adrenaline, the “just one more trade”, doesn’t change with your bank balance.

Now you have 8 figs. But the goal post changes. You want 9 figs. The hunger grows. The numbers on the screen are just fuel for the next gamble.

Even with massive gains, if your approach is driven by gambling instincts rather than sound strategy, the cycle never ends.

The money doesn’t change your nature; it only raises the stakes. You’re still a degenerate, always chasing the next win, never knowing when to walk away.

Unless the underlying mindset changes, the cycle of gambling continues, no matter how many zeros are in your portfolio.

As Gainzy said himself: “If you make money as a degenerate, at the peak you’re still a degenerate.”

10. Being reliable is an important trait (in pretty much every aspect of life - but especially in business).

Career advice that nobody gives: be extremely reliable.

I’m not a touchy-feely person. I’m not great at making friends. But people like working with me because I do what I say, when I say. I’m responsive. I follow through. I don't wait around for someone else to step up.

If I can't deliver something on time, I flag it early so others can plan around me. That alone is rare.

@sama once said the most successful founders at YC all had one thing in common: they replied to messages immediately.

It's weird—you would think the most successful founders were the busiest. And they are. But they are also always on top of of their shit.

Be that person. People will love working with you, and your reputation for reliability will compound over your career.

Bonus: Not your traditional "alpha", but very funny.

I hope you've found this thread helpful.

Follow me @milesdeutscher for more (this is a weekly series).

Like/Repost the quote below if you can.💙

784

167K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.