#BTC走势与@coolish Discussion Notes 📝

Now the market is too divided, half of the people feel that the superimposed interest rate cut will go up directly, and half of the people feel that everyone has lost all of them, and they are extremely bearish.

💡 I think: the triangle is at the end of the shock, Obv is currently low, but the price is high. So I don't think it's that easy to break through directly.

And at this current position, if you want to pull it to 120,000 again, this shock time is not enough.

!️ Wei Shen thinks: whether this is enough or not, if you add the consideration of variable speed, it is difficult to say. and whether it is enough to go up to draw the door, and whether it is enough to maintain, are two standards of whether it is enough or not.

If you look at BTCUSDT, or BTC/IXIC, there has been an obvious parabolic structure since 2017, and the difficulty of this parabola is "in addition to spring, summer, autumn and winter, there is also global warming", and this "iterative change of game version" and "global and local speed change" are the core difficulty sources of trading #BTC

If you use some carved boat perspectives, it will not work to carve the boat rigidly, and you need to draw inferences from one case and carve the boat creatively.

This kind of parabola is why many people like to use the log chart to see the long-term trend to draw a sloping channel/trend line, but I think that the log normalize algorithm itself and the parabola of the #BTC trend directly lack some first-principles level of correlation, that is, "There are many kinds of normalize algorithms, why choose this?" And the error will be very large after the log, so I don't look at the log graph.

This parabolic structure can be seen on both gold and the NASDAQ, and the plate is big enough to be typical enough, which is a good learning material

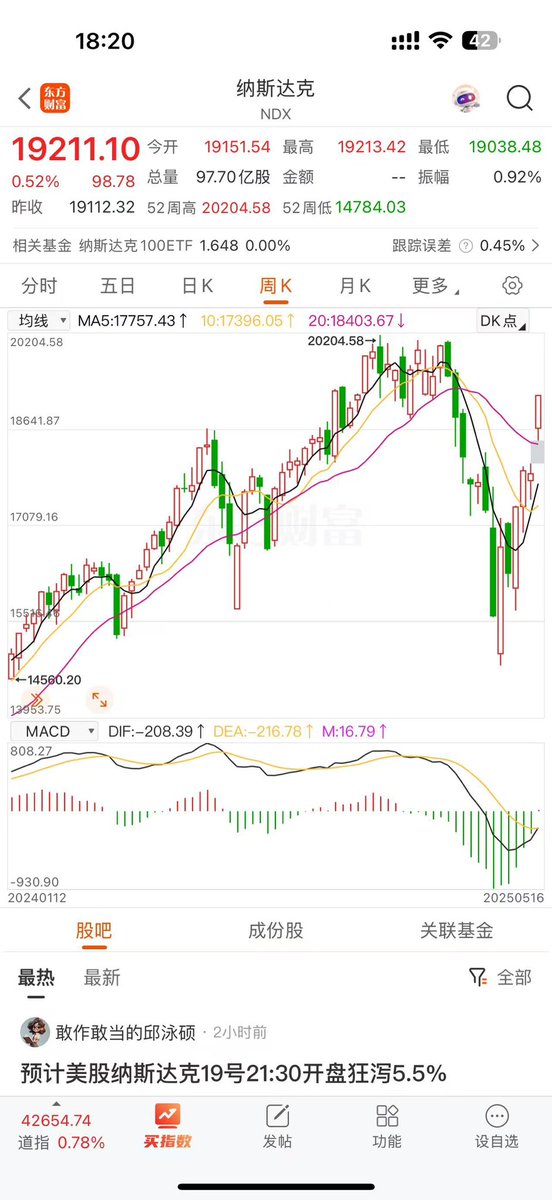

💡 I think: but there is a problem that everyone has ignored at present, as shown in Figure 1 below, the Nasdaq gap white line, and the possibility of stepping back next week is very high. I mean, last week the weekly line was pulled into place.

!️ Wei Shen: For example, on December 5, 2024, when we talk about BTC, we can understand the meaning of this "time required for shorting": "It's just ATH, if you are short, you can take profit, you don't need to short." Every time the ATH is refreshed, the time suitable for shorting should be postponed by at least 1 month. Because it takes a month to do the top. ”

Therefore, if we evaluate the probability of filling the gap, then if we also fill the gap at the weekly level, I think the probability of being later than next week or even later than next week is greater than next week. The time required is directly proportional to the time and intensity of the previous one.

See Figure 2: The top on the left is more suitable for taking profit, and the top on the right is more suitable for shorting. It took more than a month. It's because the previous game has been done for almost a year, and it has just finished rising to a large-scale main rising wave of 100 days that continues to refresh heights. To use a more figurative and anthropomorphic language, it is that the more "rare" the situation in front is, the longer it will take to reverse the head.

💡 I think: there's not much room up there, you have to go down, and I don't know when you'll get there. But the upward profit and loss ratio is very small. This one is not the top. It's the stage high. The trend is still upward, but it has to be fully consolidated downward before it rises

Summary: In fact, it is a question of callbacks and breakouts, since they are all bullish, it is good to use different strategies to deal with different situations. Embrace change.

Show original

28.77K

64

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.