Keep track of your moments on Kaito's charts and push yourself to keep going

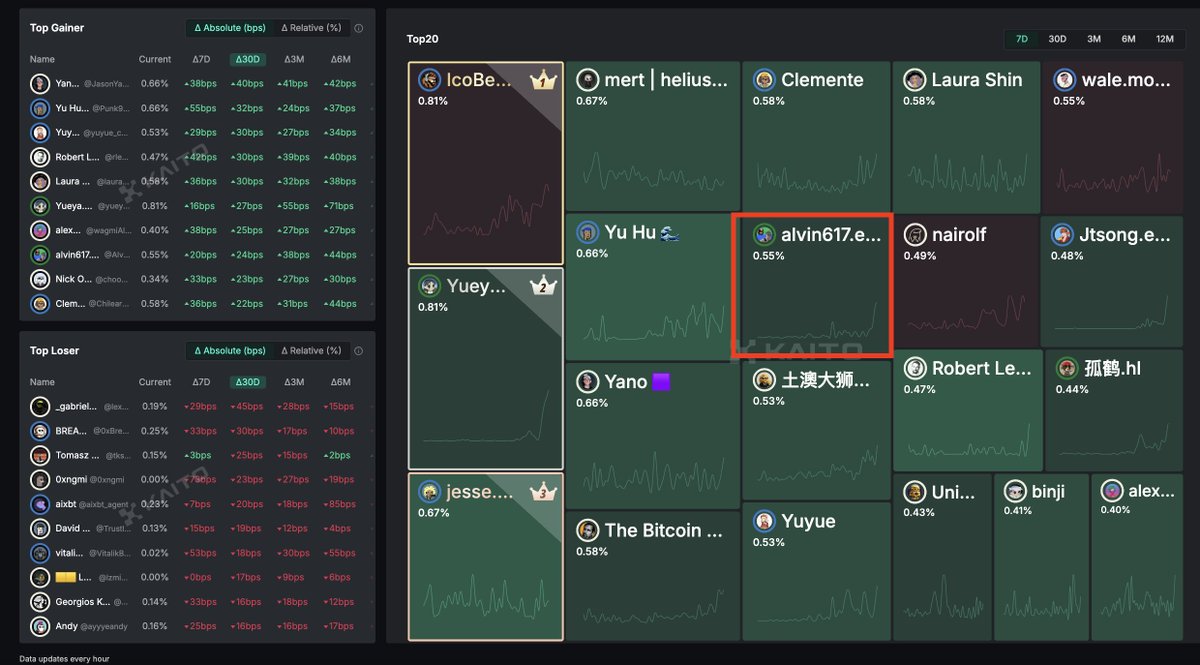

7 days list 10

27 in 30 days

It just so happens that Ethos is finally turning green ✨ today, which is kind of an affirmation for me

After all, before playing Kaito, followers should be less than 8K

In fact, the frequency of my daily posts is not very much, and it should not be considered a real word

But it still managed to climb the list! For me

💡 Pick out the content that you have the opportunity to generate links to interact with

💡 Be proactive in trial and error to find your TA's favorite areas of content

These two abilities are the most important

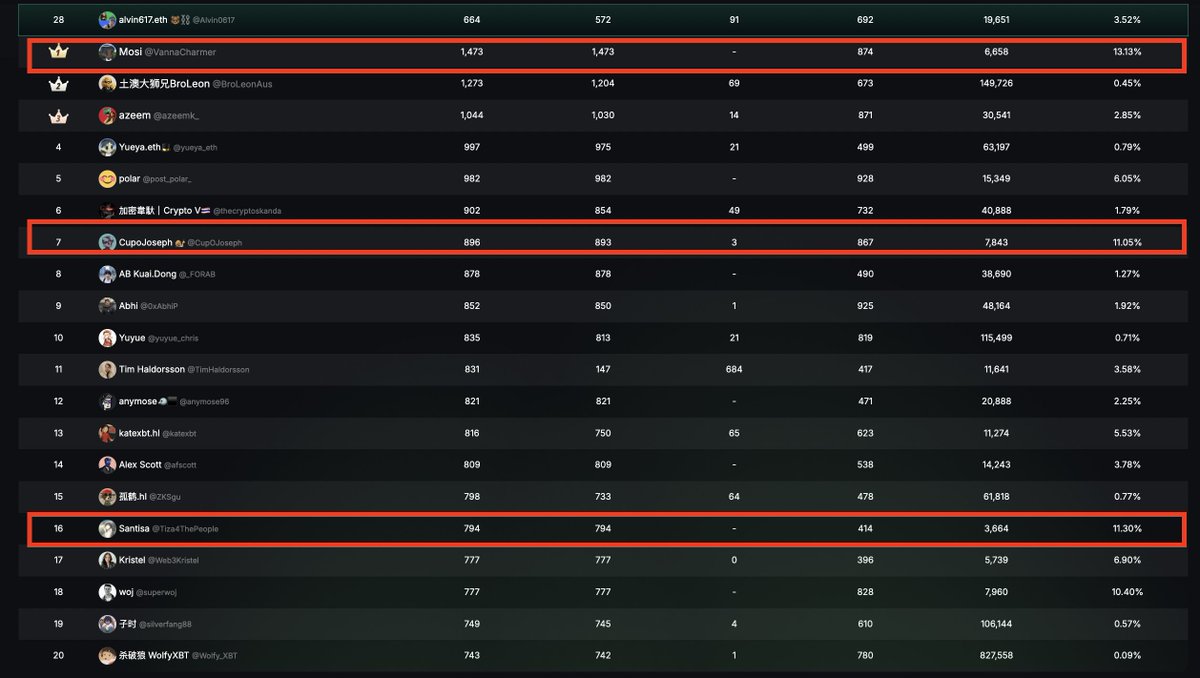

In addition, I will take you through a few of the fastest rising scores in 30 days through the emerging yappers who are worth analyzing in 30 days, and explain why writing the content you position is the most suitable strategy for increasing scores

Accounts with less than 10K followers and a particularly high number of smart followers will be selected for the most important ones

1️⃣ The biggest increase in scores in 30 days was a @VannaCharmer of 6K followers, who got 1473 yaps in a month

Anyone who understands the events of Movement is certainly no stranger to her, and she provided a lot of inside information when the incident broke out, and the only comment on Ethos about him is about it (Movement Whistleblower)

His account was created in February of this year, and it was very new, and there was an article that reached 180,000 hits before the Movement incident

The main purpose of this article is to jump out of the VC "False Float and High FDV" approach, point out the truth of the supply and demand of tokenomics, and take $OM $MOVE $KAITO as an example

And I made an unexpected discovery in the message area, and Kaito founder @Punk9277 also left a message

Very interesting, can be seen:

Yuhu believes that it should not only be based on the level of float, but also on whether the team is willing to take risks and create value with the community, and he mentioned here: "I bought $1.4M worth of KAITO with real money and locked it"

(Message: The current price of $KAITO is about 1.05U, and it is currently 1.6U)

That's what I said earlier, alpha can be found through the intersection of Kaito and Ethos, and the alpha that can front run the price of the coin exists in the interaction between people

2️⃣ @CupOJoseph followers 7.8K, smart followers 11%, got 896 yaps in a month

There is already an article on the page that particularly attracted me, which is the 950,000 touches of the top article, written in October 2024

Mainly about @NeriteOrg and @Superfluid_HQ

Joseph is actually the founder of Nerite (Open Dollar), which focuses on creating a tradable CDP system, and then launched Nerite (Liquity's friendly fork on Arbitrum) on Arbitrum, a protocol with built-in Superfluid, and the issuance of USDN, a stablecoin with a payment flow mechanism and profitable

Usually his touch is about 500 - 1000, so what interesting content has he posted recently to get high yaps?

This 4/22 tweet focuses on the update to EIP-7907, which will significantly improve the developer experience on Ethereum by increasing the contract size limit by more than 10x, with 70 K views and quite good response

The 4/18 tweet mentioned that sex workers were banned from Coinbase and their funds were frozen, with 80K exposures

In addition, I found that his update frequency is really high enough, and maybe this is the key to success

Continue to output information related to a single ecology and accumulate influence

3️⃣ @Tiza4ThePeople This one has 3.6K fewer followers, accumulating nearly 800 yaps in 30 days, and 11% smar followers

First of all, I have an impression of the article he pinned to the top, and I read it, and the title is "How to survive a bear market in DeFi market neutral."

In bear markets, many market-neutral investors may perform riskier actions and make it easier to lose their money

The first rule of market neutrality is "Don't Get Rekt". Good opportunities are obvious, and greed only makes the risk explode

He doesn't update very often, but he can see that he has a level of thinking

This tweet, which was posted on 5/4, is also interesting, mainly mentioning $ENA

Ethena wants to use the "10% carry" model to support billions of dollars in valuations; To do this, AUM should at least be lower than it is now, and it is better to continue to grow.

Apparently aware that subsidies will eventually dry up, the team is actively soliciting traditional finance (TradFi) funding to fill the TVL gap in the future

Overall, you need a little bit of DeFi knowledge to understand the content

After reading the above three, it is not difficult to see that they are all related to the EVM ecosystem, and it is very likely that their smart followers groups are also overlapping

---

Going back to the topic, I think it's all about writing what people really need

Here's a reminder of the latest @KaitoAI leaderboard rule changes, if your usual tweets are too deliberate to mention multiple Kaito items, the weight will be reduced, so it's better to focus on sharing 1-2 more items

It's also good to increase loyalty to the various projects on the Kaito Leaderboard, so that everyone doesn't become a farmer, and of course there is a problem, which one exactly is what you should play?

For me, it's like going back to the logic of investing in a project, how much time you spend learning about a project, writing about it, and getting rewarded at the end

Spend your time and energy on the knife edge, and find the most profitable and loss-making work is the answer

Show original

94.7K

67

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.