The airdrop is online, but you need to send a meme to unlock 😂 it

Dingaling Strikes Again: Can Boop Siphon Pump?

I woke up and saw that the NFT whale @dingalingts was pushing his new meme platform, @boopdotfun, so I went to research it. Remembering that he became famous by initiating a vampire attack on Opensea when he was in charge of Looksrare, I guess this time it should have been a long time in the making. Nowadays, the competition for the launch platform is fierce, but no one has ever shaken the position of Pumpfun, and this game is worth watching.

TLDR: All latecomers are on top, and the currency price is the core, and only by pulling the market can we attract the participation of Fabi Group, ignite the platform data, and give birth to the flywheel.

👉 The price rises to attract the issuance of coins, the new projects increase 👉 the handling fee increases, the airdrop increases 👉 to encourage more people to lock up the position and dividends 👉, and the price continues to rise.

1. Boop's launch mechanism

The launch mechanism of the Boop is not much different from that of the @pumpdotfun.

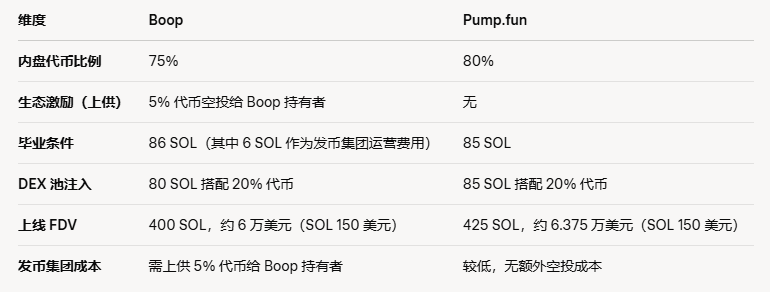

Pump is 80% token for internal users to buy, and they need to graduate with 85 SOL, and then deduct the handling fee to Pump, and inject DEX with 20% of the tokens. Boop will reduce the proportion of the internal disk to 75%, and the difference will be 5% as a "supply supply" - airdrop to Boop token holders, laying the groundwork for the follow-up flywheel.

In addition, the projects launched on Boop need to be filled up to 86 SOL to graduate, and Fabi Group can keep 6 SOL as operating expenses, and the remaining 80 SOL with 20% of the token injected into DEX, according to the current SOL price of about 150 US dollars, the market value of Boop graduation is 400SOL = 65,000 US dollars.

2. Boop's cold start: coin mining

The core of Boop's cold start is to reward the Issuing Coin Group and users through Boop tokens, which is not available in unissued Pumps, and is somewhat of a vampire attack.

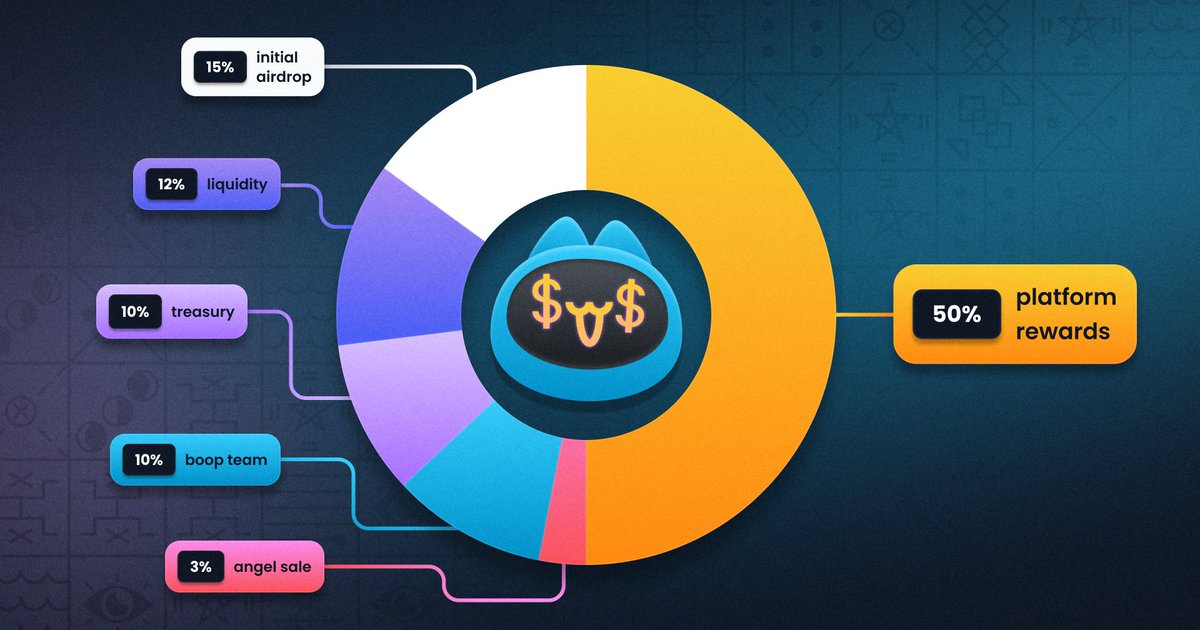

In Boop's token allocation, 50% of the total amount is used as a coin issuance incentive. Initially, 1 million BOOPs per day will be allocated to the graduation program, and if 5 programs graduate each day, each program will be graded to an average of 200,000 BOOPs. However, this part of the Boop is not all to the Coop Group, but 90% of it is given to the users of the internal snapshot and 10% to the Coop Group.

To a certain extent, Boop's launch mechanism is a bit of a "coin mining" meaning, if the Coin Group fills its own internal disk, it is equivalent to using 80 SOL cost to "mine" Boop to release, as an exchange, 5% of the total amount of new tokens will be supplied to Boop token holders, which is considered a kind of take-what each needs.

And if there are not many new projects per day, this may even become arbitrage - after all, if the cost of 80 SOL can be exchanged for a higher value Boop, there will be an "invisible" guarantee for the number of projects.

3. How do you view the token value of Boop?

I've always liked to analyze platform projects that have cash flow and revenue streams, and Boop's design has a clear context in this regard:

- 5% of the total amount of tokens for the graduation project is airdropped

- Transaction fee (before or after graduation): 60% dividend + 30% buyback

Therefore, the valuation (FDV) of Boop in a long-term stable state should be:

(Average market value of new projects on the day * number of graduated projects * 5% + platform project handling fee * 90%) * 365 * P/E multiple"

Why use the average market capitalization of the day? Because I tend to sell most of the airdrops on the day of graduation, the average market value of the first wave of on-chain projects in the current market should be a reasonable reference for this part of the cash flow.

Fees are another logic: the impact is not big in the early stage, but as the number of surviving projects increases, it will become the main source of income in the long run; Conversely, the airdrop of new projects will have a higher weight in the early stage, especially when there are a few golden dogs, and the impact will be obvious.

Therefore, although the valuation formula in the long-term stable state is determined, in the early stage, especially in the state where most of the Boop tokens are not unlocked, the price volatility of Boop will be very high, and the appearance of 1-2 golden dogs may make the Boop token holders return to their capital, so the Boop logic is different at different stages:

- Early: Dividend payback, high FDV, low liquidity

- Long-term: Cash flow valuation, dependent on fees for surviving projects

4. Boop's growth flywheel: driven by currency price

And the Boop set of things to turn up, is very dependent on the price of Boop coins, and finally becomes a typical flywheel with the left foot stepping on the right foot, that is:

The price has risen, attracting more project parties to issue coins, new projects have increased, handling fees have increased, and airdrops have increased, encouraging more people to lock up positions and dividends, and the price will continue to rise.

So in my opinion, Boop's early script would have been:

In the early stage, the disk + Golden Dog fly together, and the template can be played to attract more Fabi groups to participate and ignite the platform data.

But Pump can have today, not because of incentives, but because it has become the "most standardized speculative track", firmly occupying the mental highland of Solana's hot money. It remains to be seen whether Boop can break through and whether it will be sustainable.

2.4K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.