Deposit OLP (Ostium's LP pool) to earn trading fees + clearing fees,

Is it a good choice?

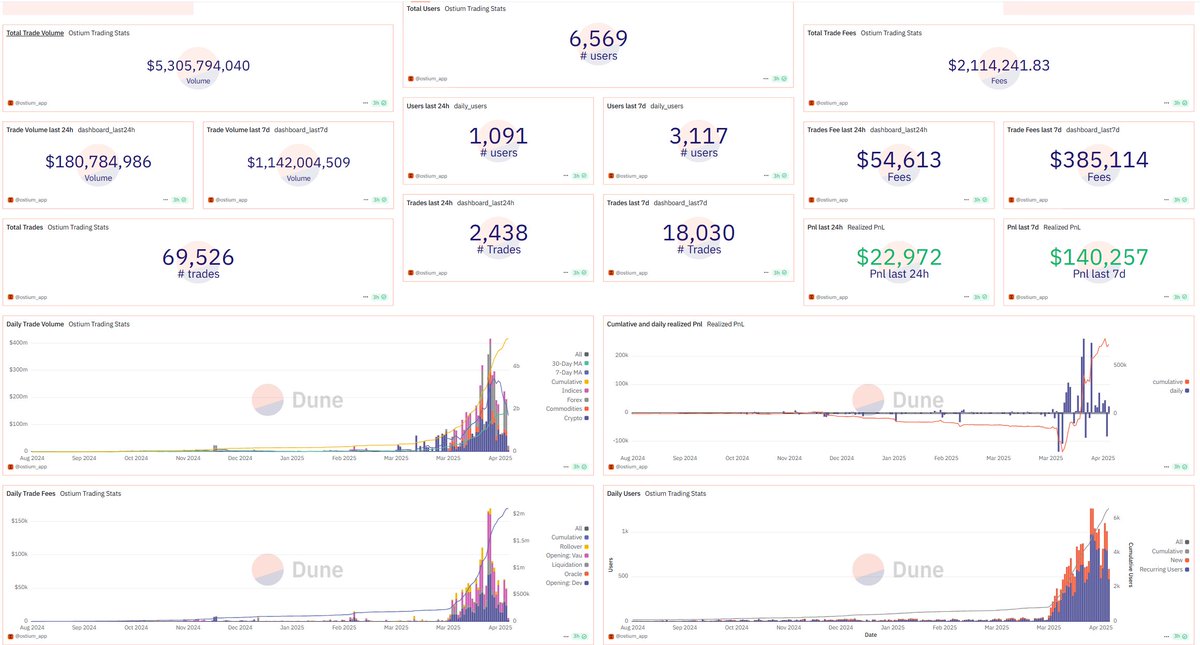

Recently, after the RWA contract exchange @OstiumLabs launched its points program, the data grew rapidly, and in just one month, the trading volume and TVL have ushered in a significant increase, which has also brought considerable benefits to users who deposit LP pools. According to the panel, the average annualized return for the past month is 18%.

However, one of the great features of the Perp DEX liquidity pool is the high uncertainty of LP returns. For a pure AMM-based Perp DEX, all users are Takers, essentially betting against the pool – when users make a profit, the LP loses.

As a result, most platforms reduce the LP's unilateral exposure through various mechanisms, but this is not without a price and is not always perfect, like a seesaw with traders and LPs on either end:

- When the LP side rises, the benefits are more

- The trader's end will decline and the benefits will decrease

It's still essentially a zero-sum game.

👉 Risk stratification: priority vs. inferiority

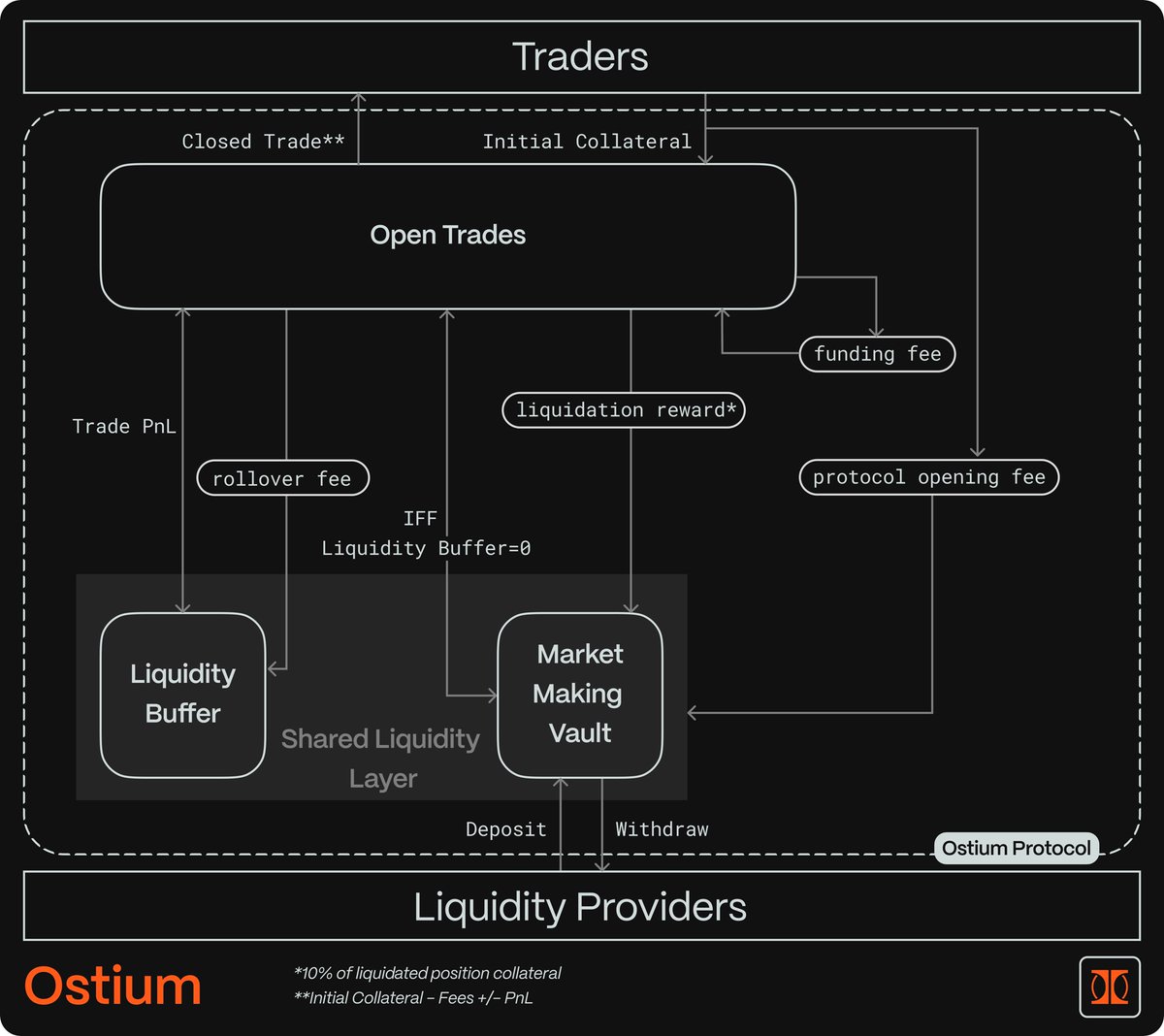

As the successor of the GMX/GNS concept, the core of Ostium's mechanism lies in the fact that it further optimizes the design of the LP safety mat of its predecessors, and stratified the risk-return structure of the senior and subordinate levels that are common in Huawei's traditional financial structured products.

- Liquidity Buffer:

It mainly acts as a risk absorption pool, which is used to preferentially pay the profit and loss fluctuations of trading users, but it can accumulate large profits when traders lose, and when traders make profits, losses will be generated. Its function is mainly to protect and buffer LPs, and avoid LPs from directly facing the impact of traders' profits.

- MM Vault (Priority Pool):

It is responsible for providing liquidity to traders, but MM Vault will cover the profit and loss as the settlement counterparty of the transaction if and only when the Liquidity Buffer is depleted, and normally only earn 50% of the transaction fee and 100% of the liquidation penalty fee. The participants in this pool are similar to the higher priority bondholders in traditional finance, and are given priority in the event of default.

To put it simply, the inferior pool is profitable by eating the user's losses, which is naturally more attractive, but the risk is also greater, and with the help of the inferior pool to absorb most of the fluctuations, the risk of the priority pool becomes smaller, and the risk-return ratio is improved, thereby attracting more funds.

👉 At present, the inferior pool is in a loss-making state

Although the priority pool has certain advantages. However, at present, the inferior pool is actually in a state of loss, which means that LPs are in risk exposure. The inferior pool has not yet been opened to absorb deposits, and only relies on the losses of traders to accumulate funds, and the safety cushion is limited.

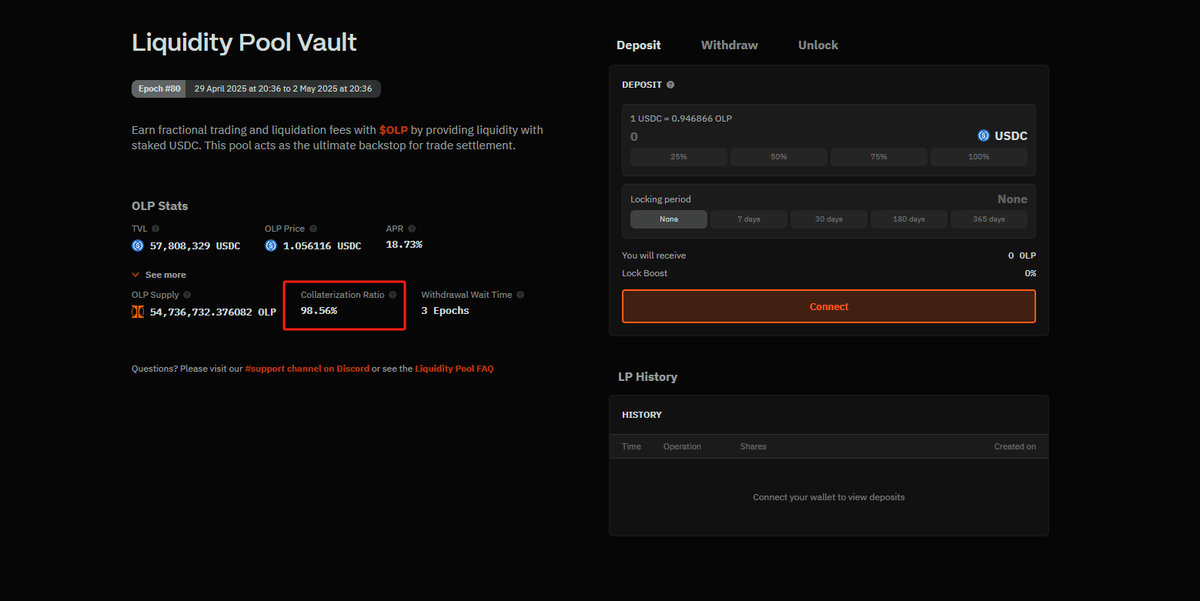

The dashboard shows that the Collateralization Ratio of the Preferred Pool is 98.56%. Based on the TVL of $57.8 million, the corresponding user profit of about $830,000 needs to be shared by the LP.

Fortunately, the performance of the platform's handling fee is acceptable, with a cumulative handling fee of about $2.11 million and a clearing fee of less than $200,000, and the LP of the priority pool gets a fee of $1.05 million and all the clearing fees, which is enough to cover the loss. If you deposit into the priority pool from the beginning, you can still make a profit overall. Clearing fees are detailed here 🔽

However, for new users, there is no inferior pool to absorb risks, and if the trading activity of the platform decreases, your uncertainty will rise in a straight line without adequate fee compensation.

👉Pain Points of AMM Perp: The Cost of LP Protection

This actually reflects a core contradiction of AMM Perp: the liquidity provided by LPs is the cornerstone of the platform, and in order to protect LPs from losses, the platform must design mechanisms to reduce LPs' unilateral risk exposure and provide risk compensation. However, this protection does not come without a cost:

- Transaction cost amplification:

When the long and short positions are obviously unilateral or the market volatility rises sharply, because there is only a single liquidity pool, and the pool may be illiquid due to withdrawal, the transaction slippage, premium, and holding cost will increase significantly, deviating from the normal market level, and then dissuading users.

- Limited LP flexibility:

The market-making strategy is completely determined by the AMM, and LPs lose the flexibility of hedging, and mostly rely on the team for external hedging, lacking initiative.

This may explain why perp DEXs that are pure AMM models often hit a bottleneck after a certain stage of development. For example, GNS, which also provides foreign exchange and stock contract trading, was only $50 million in TVL at its peak in 2023, but now it is only $25 million, and its daily trading volume has dropped to $30 million (Ostium's current daily trading volume is $150 million).

On the other hand, Hyperliquid, which adopts the combination of AMM + order book, is dozens of times larger than the above. Although the JellyJelly incident hit it a lot some time ago, AMMs are not the only pillar of the AMM - when the AMM fails, other market makers on the order book can step in, and the AMM can also choose whether to take orders more flexibly, thereby relieving liquidity pressure.

While AMM Pool's model is well-suited to farming – such as Jupiter's JLP and GMX's GLP, which have become significant underlying assets in DeFi and are widely used for staking and yield farming – with an order book, flexibility does seem to be superior, providing the platform with greater scalability and resilience, especially in the face of market volatility and liquidity challenges.

1.89K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.