Good article learning: Explain the MeMe crash principle with physical kinematics logic

Attention weight = FOMO emotional intensity × social media velocity.

See below 👇 for details

I made a MeMe crash simulator with the logic of physical kinematics,

Tell you intuitively——

Why after Trump, we don't have MeMes like WIF, Popcat, MooDeng, chiilguy, bome?

Before we get into the text, let's start with an introduction:

That's why aren't there big MeMes?

● Except for those that have long been talked about:

SOL Bonus Expires,

The macro market environment is not good,

Reasons other than illiquidity in a bear market.

● There are also reasons like DNF says:

Ai coins, CTO coins, celebrity coins, emoji coins, artist coins, Musk series derivative coins, Cz/heyi derivative coins, Alt platform coins.

We've played almost every type of token over and over again....

The cycle is accelerating, and we already have nothing left to play ...

We used to talk about the standard characteristics of a golden dog that we'd used to talk about: (1) grandiose narrative, (2) easy understanding, and (3) mass dissemination.

But this "Golden Dog Standard" now faces a problem -

We are facing the increase in market information entropy forcing the weight distribution to upgrade, and the narrative and communication path of traditional MeMe have collapsed.

In the past, our view of MeMe has always been "fun and viral", and the market's choice of MeME has always used the most "simple narrative" as the only query, and short-term emotional fluctuations as the key-value.

Attention weight = FOMO emotional intensity × social media velocity.

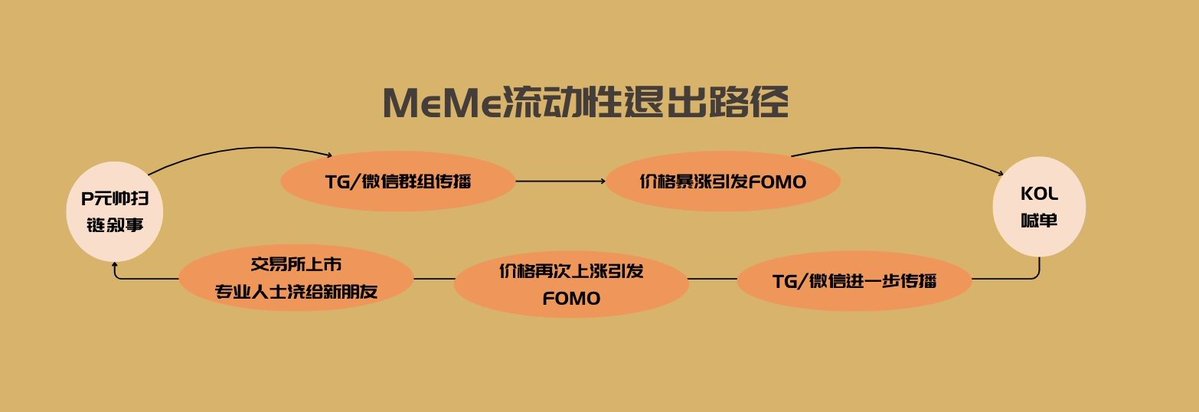

The propagation path of MeMe has always been the following exploration-

However, here's the problem - in fact, MeMe coins face the same problem as altcoins, there are really too many coins with the same narrative/technology...

And the emergence of PUMP has made our market information entropy surge, if you are active for two cycles, you will find that not only altcoins, in fact, there are more tokens with similar narratives of MeMe coins than in the previous cycle....

It is precisely because of the wealth effect brought by PUMP that everyone will swarm to find the second and third dragons, looking for the next 10x, 100x opportunities, and the final result is the chain collapse of the attention gradient.

After all, the linear narrative communication that traditional MeMe relies on has always been-

Œ/) social media → exchange listings →FOMO buying) → prices skyrocketed

This process is actually a bit like the gradient descent optimization of a neural network, which realizes price "training" by amplifying signals layer by layer, but this "linear narrative propagation" is very fragile, because this path is essentially a one-way information potential energy difference driving system.

If we look at it in a kinetic model, we can compare the voltage gradient in a circuit:

ΔV=V social media − VFOMO buys

Each propagation efficiency depends on the "conductivity" of each link.

However, the instability of the "conductivity" itself will eventually lead to a breakpoint in the system.

1️⃣ Information potential energy attenuation (social media layer) :* * KOL shouting orders no one believes anymore.

2️⃣ Conduction layer obstruction (exchange layer): Mr. Cz understands the logic of meme information difference, and for MeMe coins, the universe does not make the last stick.

3️⃣ Terminal load overload (FOMO buying layer): leek resistance evolution: generally after 3 harvests, the FOMO probability decreases by 50%...

So if you look at it with a mathematical model -

●Each time the PUMP (god coin) is broken, the trust of the community will decay:

Trustn+1=Trustn⋅(1−PUMP loss rate, community resilience)Trustn+1=Trustn⋅(1−community resilience, PUMP loss rate) is typical

The trust of the MeMe coin community returns to zero after 3 PUMP cycles.

4️⃣ Liquidity siphon effect

dtdL=−α⋅L⋅NSG α=0.17/day

Listing of new projects drains liquidity of old projects:

dLdt = −α⋅L⋅N S$α=0.17/day

Œ / ♥ So whether you choose to believe it or not, the hellish difficulty of the "meme" we are facing now is because-

Leeks have evolved, dealers have been ruthless, transactions have not been paid, and various "conductivity" of the large-scale propagation path of MeMe in the past has gone wrong.

- Decoupling narrative expectations from price feedback →Whether it's leeks like you and me, or bookmakers, or exchanges are actually voting with their feet to accelerate the withdrawal....

If you find the above model interesting, you can go to "

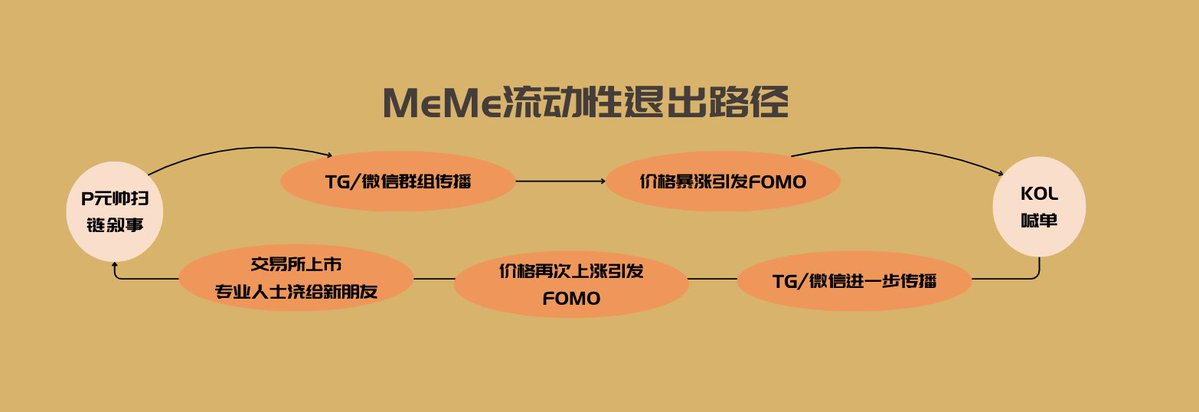

You can try to control:

1️⃣ NEW COIN ISSUANCE RATE ,⃣, PUMP 2️ LOSS RATE ,⃣ 3️, COMMUNITY RESILIENCE

What kind of path does it take for these three to complete the average market value growth of the token market value in the simulated cycle environment, and what kind of trade-off between the three will lead to the continuous collapse of the "average token market value".

Of course, there is a flaw in the model, because "MeMe itself is also a cyclical emotional asset", it cannot take into account the larger cyclical changes, and in addition, MeMe itself is a dynamic game, and the model cannot accurately judge the concrete, that is, the "crash" of a single MeMe.

Just for reference –

But if you use the above emulator and play "MeMe Simulation Crasher", you will get an obvious result, that is--◊◊◊ It seems that the more new coins, the higher the loss rate, and the lower the average market capitalization.. The higher the percentage of crashes.?

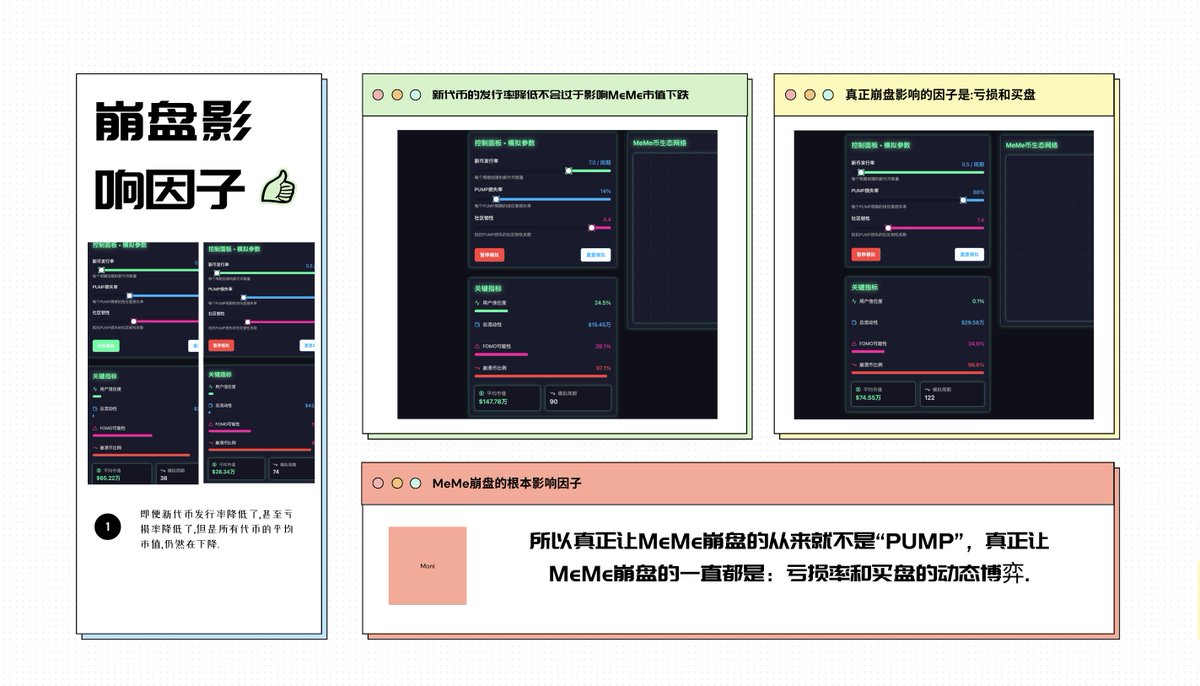

So in the past few months, everyone has scolded "PUMP" and said that "the reason why MeMe collapsed" was because of the birth of PUMP-

Because of the emergence of "PUMP", everyone has too many choices, so the consensus has not gathered, and all of them have caused the "MeMe collapse"?

Is this really the case? No.

If you are in the "MeMe crash model", even if we pull the "new coin issuance rate" to the lowest and write the loss rate as "80%", that is, 80% of people lose money, and the community resilience is given 4.5 (very high), you will find a conclusion:

——

Even though the "number of cycles of token issuance" has decreased, the average market capitalization of tokens has continued to decline as the simulation cycle progresses, which is what we say: the ceiling of MeMe is getting lower and lower.

● So it was never "PUMP" that really made MeMe crash, it was always what really made MeMe crash: the imbalance between the loss rate and the buying order.

The speed of issuing tokens has never been the deciding factor.

MeMe itself is actually a very "closed" market - just like many old players, they are a little play for the MeMe market itself, and they don't like the "casino" logic, let alone whether there is a cz teacher or not, and they don't like to play MeMe.

Without PUMP, many MeMes are not liquid, and if they do not have liquidity, they will not have the "community resilience (buying) impact, and the final outcome is still - collapse.

To some extent, the essence of the PUMP mechanism is to forcibly inject negative entropy flow into a closed system (single MeMe ecosystem) to create an orderly structure (price skyrocketing) in the short term, and then the liquid assets can complete the exit.

This is what the @thecryptoskanda said: "The market will always reward" - the team that can continue to create assets and markets with high volatility and high liquidity at the lowest cost.

This is why the owner has been emphasizing the greatness of "PUMP", and the MeMe market itself is closed - MeMe has always been a very pure capital market and Ponzi dynamics • System energy has always relied on internal circulation:

Œ/u funds → push up prices → attract more funds

The emergence of PUMP has attracted countless "new funds and new people" to enter the market, and these years like me have completed the flow of internal circulation.

To some extent, the emergence of PUMP or the PUMP mechanism is an attempt to create a perpetual motion machine in a closed box, but the problem is that forcibly creating a local low-entropy state in a closed system violates the iron law of "global entropy is not reduced", so the collapse is inevitable, which is also visible.

▽▽▽ /} But this is not caused by PUMP, but by the iron laws of physics.

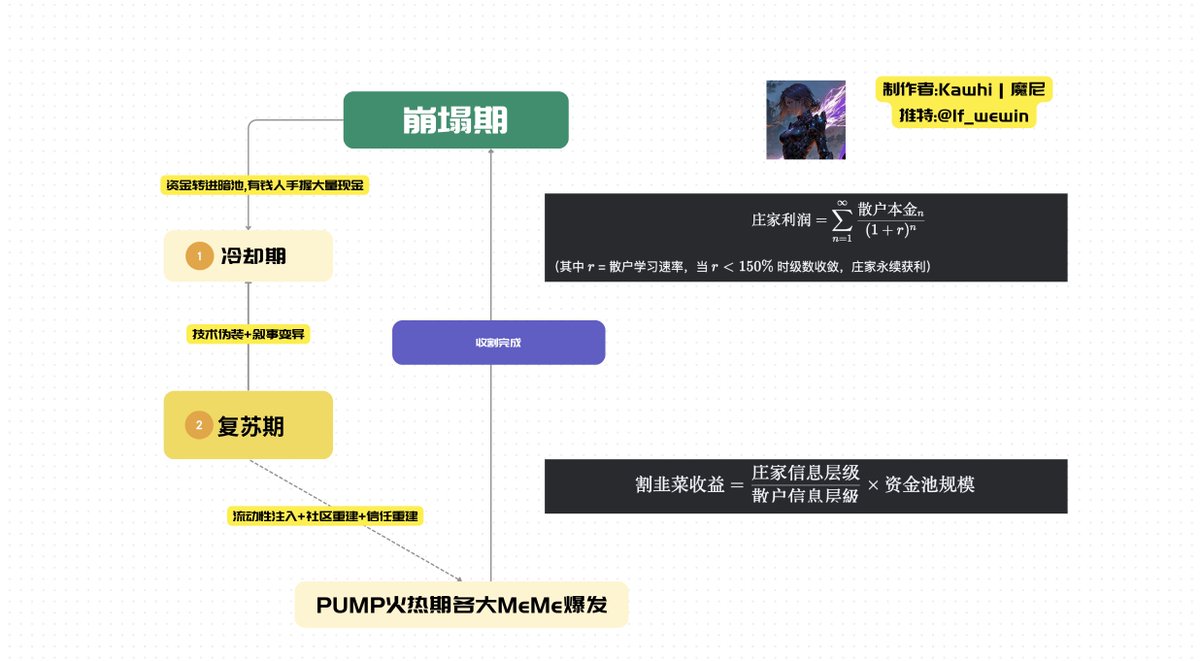

However, just like the logic of the "shrinking universe", it is precisely because of the crash that there will be a cycle of new "Big Bang" cycles.

The beginning of this cycle will be interesting.

It seems tongue-twisting, but it's actually not complicated at all, because it is a perpetual motion cycle that realizes "harvesting-repairing-harvesting again".

Π/- Let's just say: if the more elegant cutting leeks -

After the collapse of liquidity, in fact, leeks like you and me are in a "wait-and-see state", because of dissatisfaction with the existing emotions,

So a new narrative is needed, and a new "narrative" is what is called "new camouflage and narrative variation of technology"...

We have to believe that there is a new "recovery period" before we start buying...

What's interesting here is that, according to the Ebbinghaus curve:

Design cooling-down period length T=ln (maximum loss of memory intensity)/λln, where:

λ = new narrative bombardment intensity (usually set to make T≈6−8 months)

To a certain extent, you can also understand that "leeks" basically only need "6-8" months to "rise out and cut again", of course, this is not certain, because it is also related to the "damage" of old leeks and the proportion of new leeks, but the logic remains the same...

When AI+MeMe begins to officially recover, and one day in the future it becomes "technology is a rat crossing the street", we will once again embrace the narrative power of PUMP MeMe.

This is very similar to the dividends brought by the high-valuation VC coin that everyone shouts about the narrative MeMe, so many things seem to have changed, but they haven't changed.

Π/- The essence of the bookmaker's hyper-loop harvesting technique is a time arbitrage game of funds.

The only thing that has changed is that if you look for the so-called "technical disguise" and "narrative variation", what you need to learn is not how "Zhuang" is disced, because the on-chain data is too easy to deceive people, and the difficulty is increasing.

But we can't help but dance with Zhuang, after all, in the process, we will either become sickles or fertilizer.

So this is also the reason why I have always admired Sister Hui's @0xmagnolia, such as Sister Hui's "MCP" meMe from traditional meme to narrative mutation meme to technical camouflage, Sister Hui is always looking for a new alpha, and the judgment of "Afar" and right, this is really endless.

The dealer is improving, and continues to evolve the harvesting technology,

Only by turning ourselves into an open system (continuous learning of real technology) can we avoid becoming the next leek, and in this never-ending entropy war: "the escape speed must exceed the entropy increase speed", we can survive in the dark forest,

What we want to learn is "Chapter Beihai"——

Here's what to do: "Natural Selection, Forward Four"

Do more positive ev things, swipe less Twitter, and watch push projects to push memes.

What is positive ev?Hua Ge @off_thetarget The recent push also said very clearly, become an insider, learn upward, get close to power, become power, and learn a lot.

In fact, this is PUMP, it is not enough to be an influencer, in fact, to be a person like PUMO, to be a person who generates liquid value assets,

That is, you are the wealth itself.

I will cheer and hope that you who read this article will also cheer up.

Share.

10.26K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.