Low-Custody-Okra

L

Low-Custody-Okra

2Following

0Followers

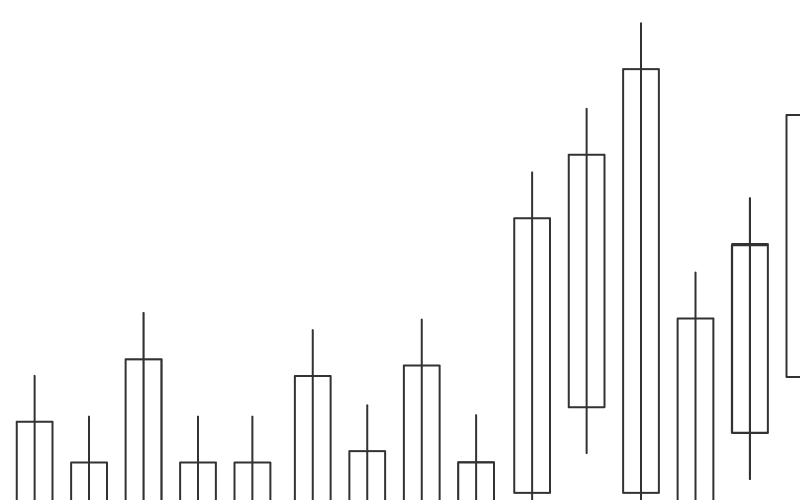

From the stock K-line to the futures leverage, to the diurnal fluctuations of spot gold and silver, I have practiced "market sense" and "discipline" in the traditional financial market - I have also carried orders through the explosion of positions, and finally learned to engrave "risk control" into every open position. In the past three years, I have switched to virtual currency contracts, from BTC to ETH, witnessing the madness and rationality of the crypto market, and I also understand the game of "trend" and "emotion" better.

For me, trading is a dual cultivation of data and mentality: don't chase hot spots, only believe in logic; Don't bet on luck, just probability. After all, the market is always changing, but "fear of risk."

Adhere to the daily review of transaction records, iterate the two-factor model of "volatility filtering + capital flow monitoring", and control the maximum drawdown in the past year within 12%. Always take "survive to win" as the iron rule, refuse high-leverage gambling, and focus on sustainable compound interest

Show original

Overview

Futures trades

This trader has hidden their personal trades.