Previous-CDP-Sheep

Previous-CDP-Sheep

15Following

6Followers

(The blogger is just a tool person to open a position, and everything strictly implements the trading strategy)

With an annualized rate of more than 30%, trading is a long process and will not be heavy

The core of the transaction, control the position, and confirm the safety of funds!!

Time for space, initiative for stability

Establish tenacious trading resilience and multi-echelon preparation to resist unexpected shocks

Gain the initiative in the process of lasting attrition

1. Small positions enter the market on multiple lines, each position accounts for 0.1-0.5% of the total funds, open a position for each order, default full loss, and be prepared for long-term positions (the contract is only short, and the long-term anti-single eats the funding rate)

2. The enemy advances and I retreat, and the enemy retreats and I advance, on the premise of financial security

(Follow the trend to make orders, spot long, contract short, high short, low spot, reserved funds for hedging)

3. Grid strategy trading, enter the market at a suitable point, multi-line sniping, fund dispersion, and ensure the safety of funds for the second time

(Be prepared for long-term grid arbitrage, tug-of-war, and also a kind of capital reserve)

Show original

Overview

Futures trades

Spot trades

Bot trades

Stats

Total PnL%+5.22%

Total PnL+$210.72

Assets$4,243.87

Days active205

Max drawdown-23.74%

Win rate

78.57%Profit/loss ratio

0.07:1Net transfer$2,630.99

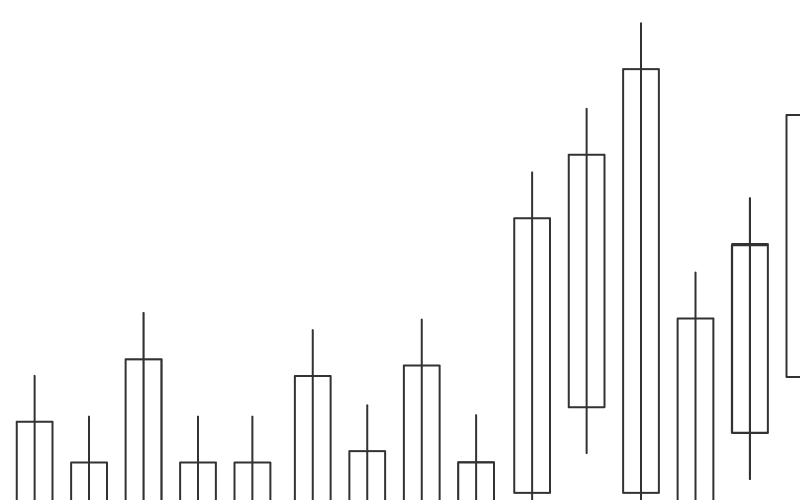

PnL%

PnL

Assets

--

Positions (1)

Assets

Latest records

Open positions

History

Open positions

0.93x short

PnL

-375.38 USDT

PnL%

-1,050.44%

Size

--

Margin

39.48 USDT

Maintenance margin ratio

23,886.03%

Entry price

4,140.81

Mark

4,575.78

Est liq. price

9,451.62