$ETH breaks 3700! 🚀 Is the E-Guardian finally seeing the light?

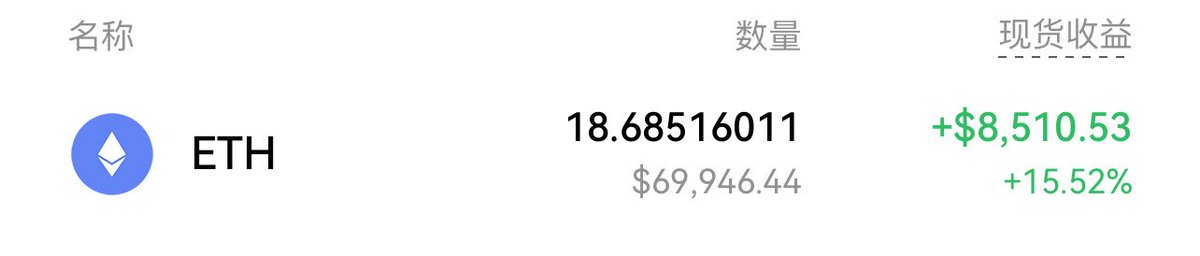

The E-Guardian has finally seen the dawn 🥹 Facing the pressure of historical highs and countless FUD, it’s truly challenging to hold onto coins. Today, I opened the exchange, and part of my spot holdings reached my target price. For web2 investments, this return is already quite good. I’ll keep some in my cold wallet and observe the market trends 👀. Of course, this rise in ETH is driven by more than just sentiment:

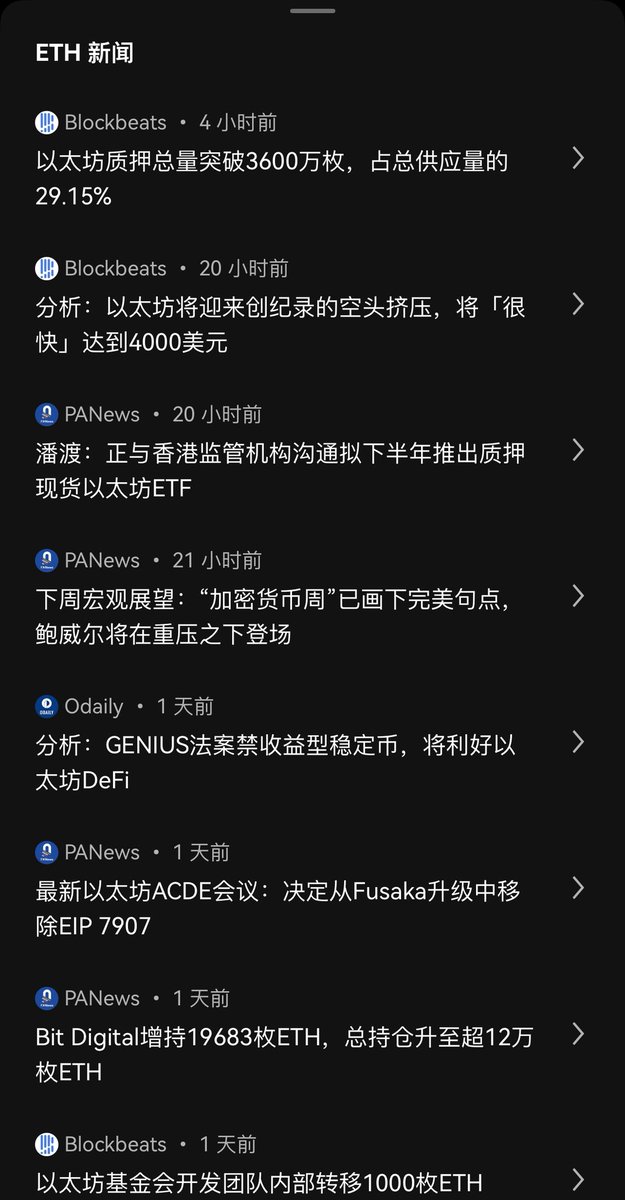

💡 Long-term value cornerstone: The "GENIUS Act" has been implemented!

🔸 It clearly establishes $ETH's core position in the issuance and use of stablecoins, effectively recognizing the legality of crypto.

🔸 This law brings legitimacy and confidence to the crypto industry, attracting banks, tech giants, and retail behemoths to flood into the stablecoin arena, with the market expected to reach $500 billion - $1 trillion by 2026.

🔸 $ETH accounts for about 70% of the stablecoin market ($250 billion!), where every transaction of USDT, USDC, etc., incurs Gas fees, leading to a surge in transaction volume = increased demand for ETH!

🔸 Ethereum's flawless operation over the past decade and its absolute dominance in DeFi make ETH the preferred underlying asset in the stablecoin wave.

Another point is that many new whales are entering ETH;

The ETF flow reflects this trend.

As of July 16, 2025, the "ETH version of MicroStrategy" SharpLink holds 321,000 ETH (about $1.1 billion), surpassing the Ethereum Foundation.

To mention, in May this year, SharpLink secured $425 million in private financing led by ConsenSys, announcing its transformation into an Ethereum strategic reserve company, with Ethereum co-founder Joseph Lubin as the chairman of the board. They have now become the largest enterprise-level ETH holders globally.

When institutions start buying in large quantities, it’s rarely random.

They must have conducted systematic assessments, such as the liquidity of the ETH ETF, rollup scaling, the narrative of re-staking, or some larger-scale factors. You wouldn’t spend $500 million on an asset unless you believe it’s still early.

In June and July, investment tools for Ether saw a revival, with positive capital inflows on 11 out of the past 12 trading days.

On just Wednesday, over $726 million flowed into ETH.

The belief in ETFs has returned.

And belief is the driving force of a bull market.

Of course, everyone should also be cautious of the rising bubble, always strictly follow their position management plan, and pay attention to price corrections.

Always remember: a bull market is a great retreat.

In the long cycle, be mindful of taking profits and securing gains.

Reduce positions at highs to preserve profits.

Show original

13.41K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.