We're pretty close to where we'll see Curve's growth accelerate, from a DEX that is best known as the place to swap stablecoins to what I can see as the main source of liquidity for blue chip assets on ETH mainnet, starting with BTC.

In a world where you, as the liquidity provider, can choose whether to deposit into a pool with impermanent loss or without, I think it's pretty straightforward.

Even if fees offset IL, you'd perform even better earning those fees in a system without IL to start with.

It's only a matter of time...

_YB

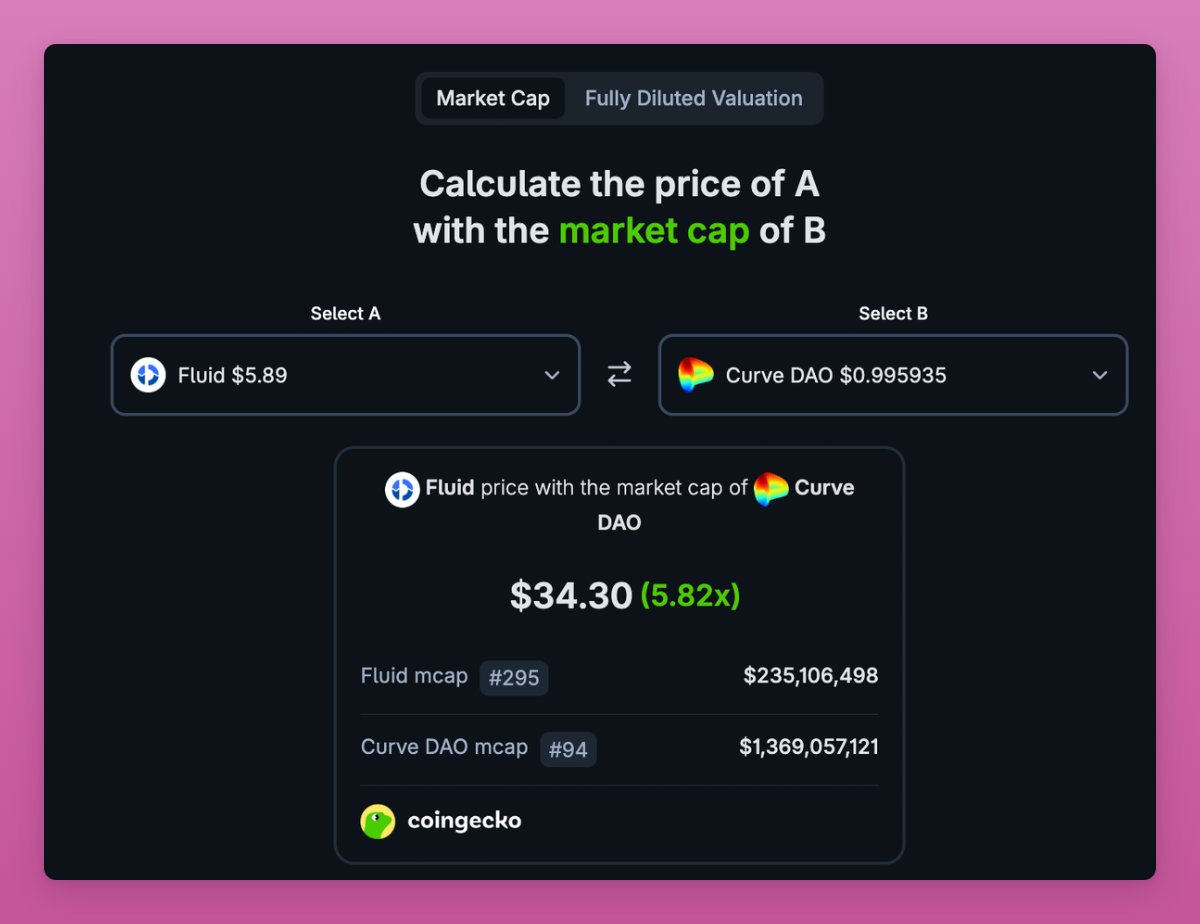

$FLUID should catch up with $CRV

- TVL: Fluid $1.5B vs Curve $2.5b

- Trading volumes: Fluid does 2x the Curve volumes

- Monthly fees: Fluid generates $5.37m vs Curve's $1.9m

At $10m annualized revenue, $FLUID will start buy backs. That number is $6,6m now.

I love Curve, but FLUID seems a better bet now.

Disclaimer: I hold loads of FLUID

7.6K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.