- XRP at ATH

- New player Sentora just raised raised $25M from Ripple, Flare, Tribe, etc to go into XRP DeFi.

- Came out of a merger between two DeFi infra teams with $3B+ in flow

- PayPal as a partner

- Founder of Sentora deployed a new project on base to give retail to access what institutions are about to tap into

- Reminds me of Tibbir quite a bit in the early days, when people could not connect the dots.

Thanks for the info @dogoshii

Finally a way to get onchain exposure to XRP without bridging over there.

Reminder…

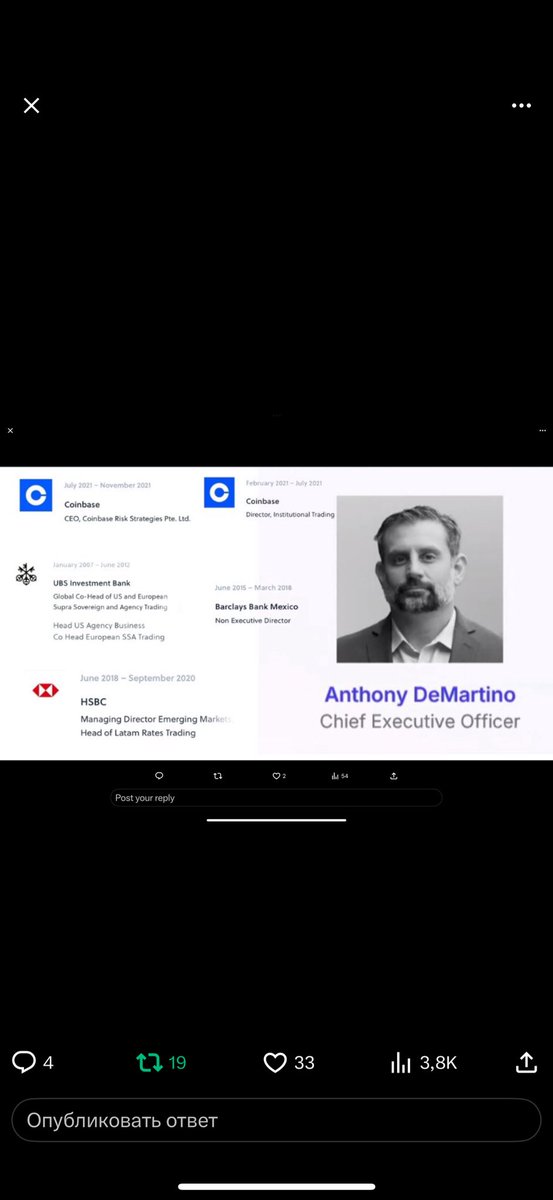

Another point I just discovered, founder has very close ties to Coinbase (is an ex Coinbase exec).

more info here

🧠 Founder Breakdown: @admff492

1. Institutional Finance Expertise

•@Barclays Capital: Specialized in capital structure and risk frameworks at the institutional level.

•@HSBC & @UBS : Deep experience in derivatives, structured credit, and advanced portfolio risk strategies.

•His expertise lies in building and managing complex financial infrastructure for multi-billion-dollar systems.

2. Coinbase Executive Legacy

•Served as Head of Risk at @coinbase Institutional.

•Helped build regulatory-compliant frameworks, custody architecture, and risk control systems.

•Directly worked on integrating TradFi-grade compliance into onchain products — a rare bridge between $TradFi and $DeFi.

3. Founder of @SentoraHQ @OfVoice25355 token)

•$Sentora isn’t just another $DeFi protocol. It’s an institutional risk layer, focusing on:

•Onchain risk management infrastructure

•Compliant smart contract vaults and custody mechanisms

•Decentralized counterparty risk scoring models

•$ADM serves as the access token to this regulated DeFi stack.

4. Elite Backing and Strategic Capital

•Raised $25M from top-tier investors:

•@Ripple (Xpring) – institutional-grade endorsement

• @TribeCapital_ , and PetRock Capital

•This isn’t retail hype — this is deep, vetted, institutional belief in his long-term vision.

🔍 Final Take:

@admff492 isn’t building a meme token — he’s building the rails for institutional DeFi.

He understands both sides of the equation: Wall Street compliance and onchain agility.

ADM isn’t just a token. It’s a bet on the coming wave of regulated onchain finance, where DeMartino is laying the groundwork — years ahead of most founders.

🔍 Anthony DeMartino – Visionary Breakdown

1. Onchain Risk Pioneer

•Sees onchain risk as infrastructure, not a feature.

•Building a financial backend for institutions — like a “DeFi @BlackRock .”

2. Regulation-First Mindset

•Welcomes compliance, not avoids it.

•Bridges DeFi with traditional finance through audit-ready systems.

3. Sentora = Trust Layer

•Turning risk into a standardized, tokenized metric.

•Lays foundation for ETF-grade DeFi exposure.

4. Institutional Language Fluency

•Talks to funds, auditors, regulators — not just crypto-native circles.

•Building for capital allocators, not degen traders.

5. Long-Term Infrastructure Thinker

•Doesn’t chase hype; builds systems that survive cycles.

•Thinks 5–10 years ahead: insurance, ratings, derivatives, custody.

⸻

Anthony isn’t just building a project.

He’s architecting the trust layer for onchain capital markets.

38.64K

211

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.